Citigroup Chief Economist Willem Buiter says Australia is experiencing “a spectacular housing bubble” that needs to be addressed with tougher regulatory measures – something we’ve noted time and time again.

A shortage of housing, coupled with record-low interest rates, has made Sydney the world’s most second-most expensive property market. The city’s home prices jumped 16% in the 12 months through April, stoking record household debt and putting home ownership out of the reach of many.

“It had better be focused on immediately, to try and tether a soft housing landing,” Buiter told reporters in Sydney Wednesday, according to Bloomberg. “Clearly if these things are not managed well they can be a trigger for a cyclical downturn.”

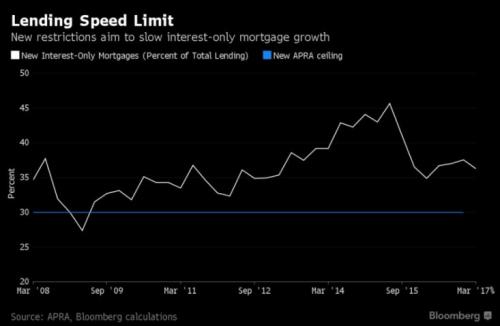

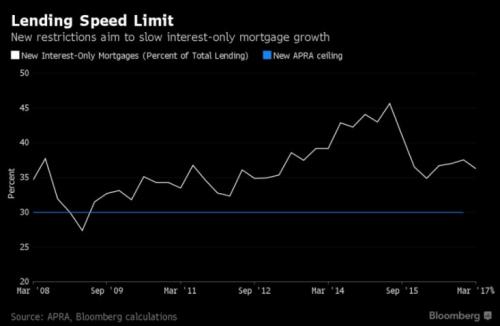

Australia’s biggest banks have been tightening their lending standards under pressure from regulators, making home loans for investors and interest-only mortgages more expensive, Bloomberg.

The Reserve Bank of Australia, which has cited the east-coast property markets and their impact on financial stability as a key concern, is in a tough spot. While it’s reluctant to cut the benchmark interest rate from 1.5 percent and stoke prices even higher, lifting borrowing costs would place a greater burden on households saddled with debt already at 189 percent of gross domestic product, Bloomberg.

Investors, for their part, are starting to come around to the dangerously overvalued nature of Australian stock and housing markets. Earlier this week, Australian asset manager Altair Asset Management made the extraordinary decision to liquidate its Australian shares funds and return “hundreds of millions” of dollars to its clients according to the Sydney Morning Herald, citing an impending property market “calamity” and the “overvalued and dangerous time in this cycle”.

Leave A Comment