By Bryce Coward Knowledge Leaders Capital Blog

With the euro up another 50bps today against the USD, we thought it timely to review some fundamental factors that should act to support the longer-term trend higher in the euro. No doubt, this week’s substantial move was partially instigated by what were viewed as hawkish remarks by the ECB. Yet, there are at least three other fundamental reasons to expect the euro to remain strong in the back half of 2017 and beyond.

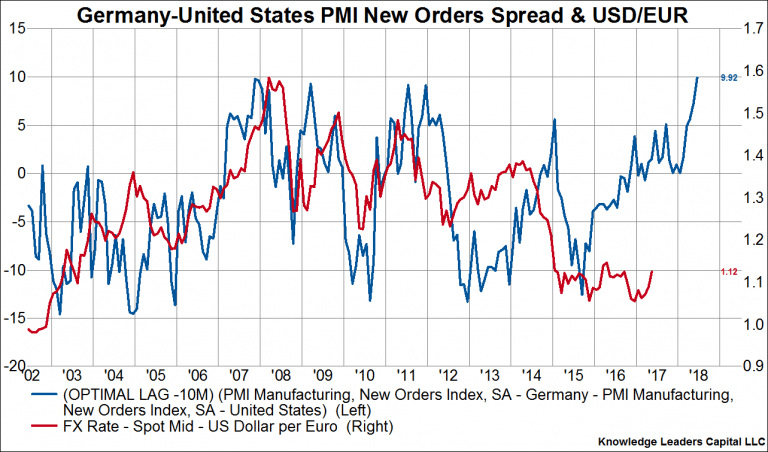

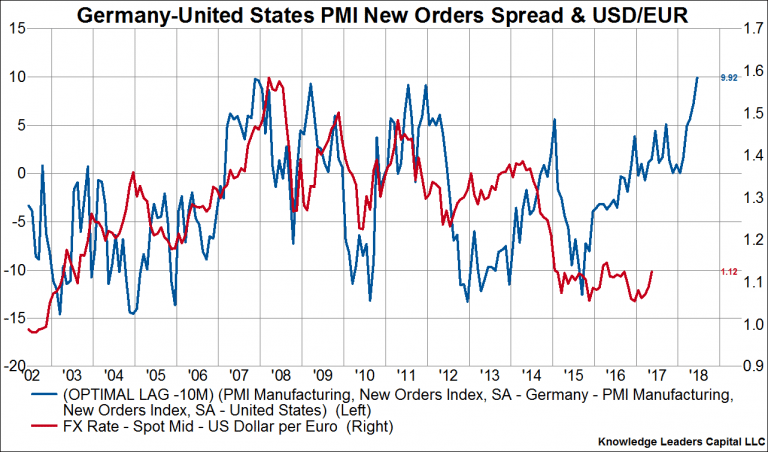

Reason 1: European economic prospects have diverged from US economic prospects.

In the chart below we plot the difference between the German and US new orders component of the Markit manufacturing PMI series and then overlay the USD/EUR spot rate. New orders are often viewed as leading indicators of the overall PMI index and the spread between these two series is often indicative of the direction of the USD/EUR, with a lead of about 10 months. German new orders outpacing US new orders by the widest margin since 2007 suggests plenty of runway for the euro to rally against the USD.

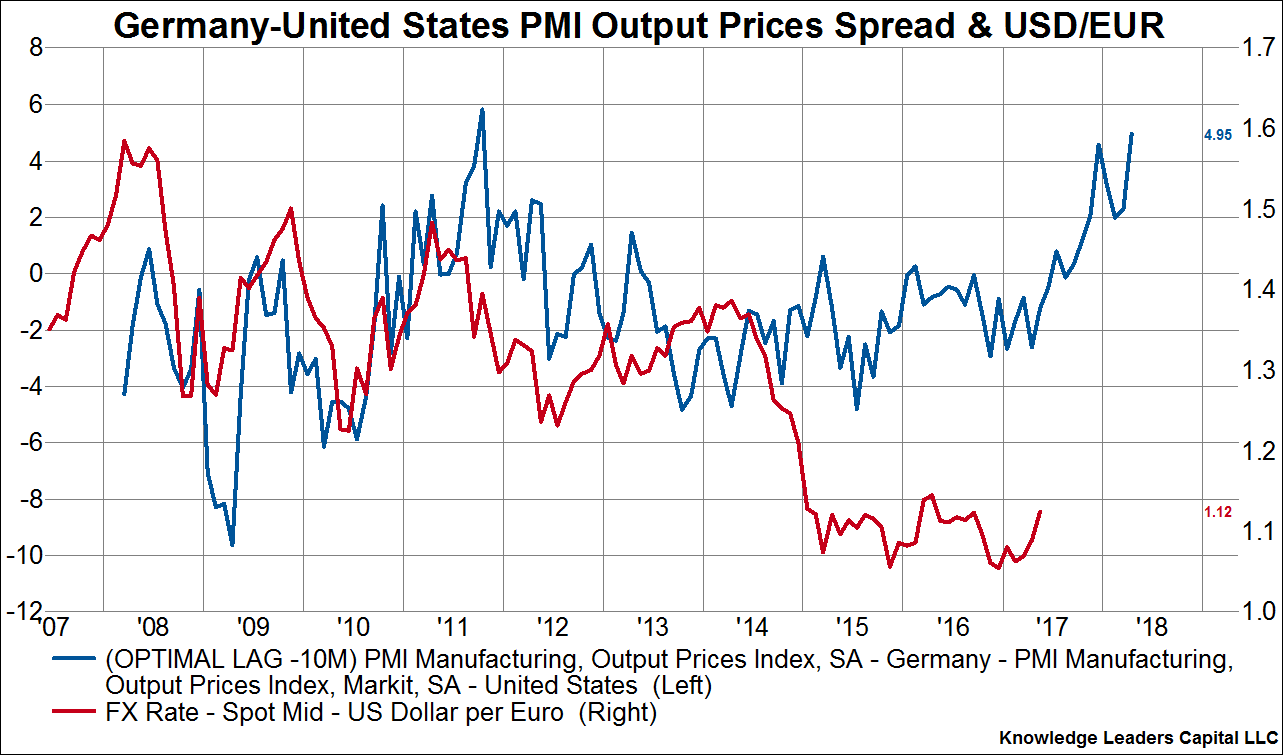

Reason 2: European price levels have diverged from US price levels.

In the chart below we plot the difference between the German and US output price component of the Markit manufacturing PMI series and then overlay the USD/EUR spot rate. Output prices can be one indication of supply chain pressure resulting from economic growth. The spread between these two series has led the USD/EUR spot rate by 10 months throughout this cycle. German output prices outpacing US output prices by the widest margin since 2011 suggests further upside for the euro vs the USD.

Reason 3: The euro is nearly one standard deviation undervalued vs the USD on a purchasing power parity basis.

The euro has spent the better part of the last decade being overvalued vs the USD. In 2015 the euro finally became undervalued and early in 2017 it became one standard deviation undervalued. If the euro rallied another 10% from here it would still only be fairly valued vs the USD on a PPP basis.

Leave A Comment