There isn’t really any doubt what happened on May 29. It was a global collateral call. Bonds all over Earth were hugely bid, especially paper in Germany and America – the pristine of the pristine. This is pure liquidity risk, meaning that no matter your feelings on the long-term solvency of the US government (or Germany’s ability to maintain the euro bloc) the debt instruments they issue are liquid under almost any conditions.

For financial institutions with all that has happened over the last decade (including constant reminders central banks haven’t achieved anything of substance in the liquidity department), it doesn’t matter this so-called bond bubble. If you think things are heading the wrong way (again) those long off considerations mean absolutely nothing; what matters is tomorrow when your funding counterparties (JP Morgan) call and demand you put up more of something negotiable.

You need only survive until tomorrow, even if the mad scramble for what little pristine securities may be available at any price.

This is, obviously, not a very good sign about how things are going in the realm of effective global money. Collateral flow requires concerted effort by money dealers, the real monetary substance of the modern eurodollar system. QE’s and their bank reserve byproducts solved nothing on that score.

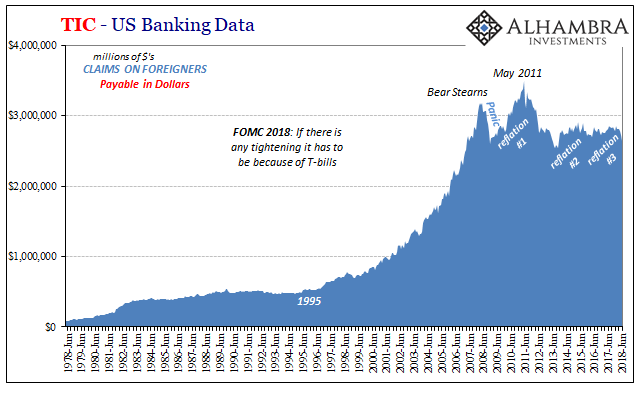

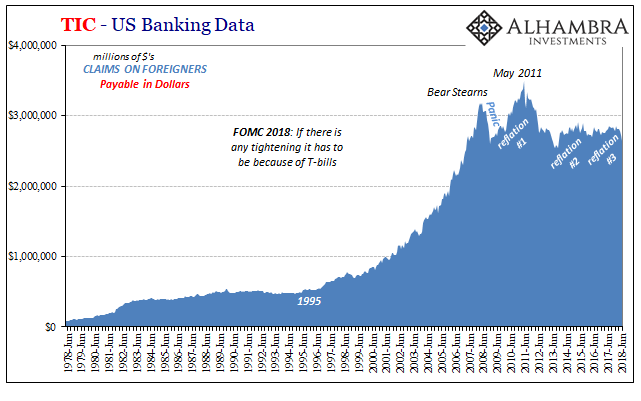

The Treasury Department’s TIC data for June 2018 almost surely has picked up the aftermath of May 29. Unfortunately, after reviewing all the relevant data it will leave you with more questions than answers – a familiar condition for eurodollar investigations of this kind.

Let’s start with what we already know and expect.

On the “blue” side, various dollar instruments being lent to overseas counterparties by US banks, we unsurprisingly find more evidence Reflation #3 ended. Consistent first with global liquidations in January, there is a clear downward trend (negative eurodollar liquidity or money) starting right after that particular month.

Leave A Comment