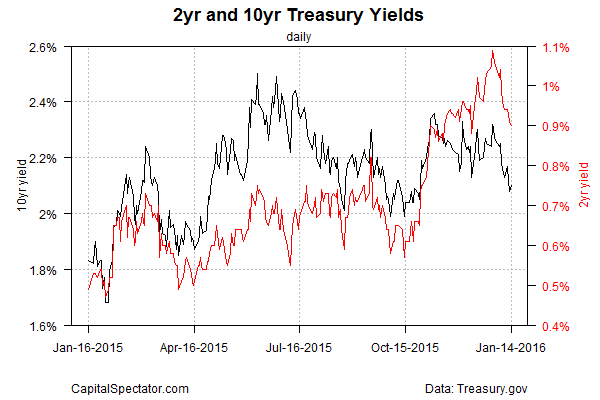

Treasury yields have made a sharp U-turn lately. The 2-year yield—considered the most sensitive to rate expectations—has been sliding this month, falling to 0.90% yesterday (Jan. 14), based on daily data via Treasury.gov. That’s the lowest in about a month. The benchmark 10-year yield has lost even more ground, slipping to 2.10%–the lowest since late-October.

The softer yields so far this year reflect renewed worry about a variety of factors that may weigh on economic growth in the US and around the world. The short list includes concern about China’s economy, ongoing instability in the Middle East, and a fresh round of concern that the US recovery has decelerated… again.

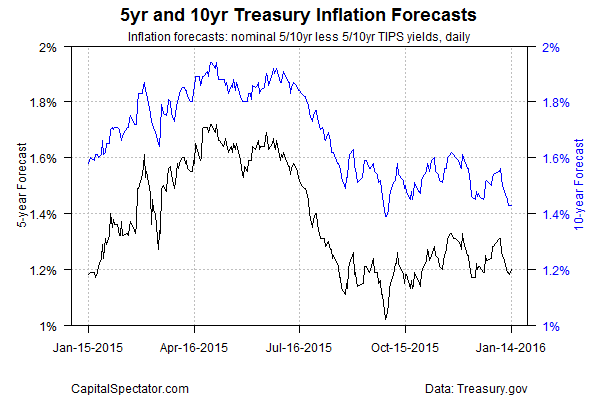

Market-based inflation expectations are in retreat again too. The implied estimate via the yield spread on the conventional 10-year Treasury less its inflation-indexed counterpart has been bumping along at 1.43% in recent days—the lowest since late-September and well below the Federal Reserve’s 2% target for inflation.

The counterpoint to all this: the US economy doesn’t appear to be sliding into a recession, based on the current numbers (see yesterday’s analysis for details). Nonetheless, growth has softened lately, perhaps sharply. The Atlanta Fed’s GDPNow model projects that fourth-quarter GDP growth weakened to just 0.8% (as of Jan. 8)–less than half the rate in Q2.

A new survey by The Wall Street Journal highlights the current state of macro:

Most economists think the American economy will continue to expand, but weakness abroad is heightening their concern about U.S. growth. Forecasters in The Wall Street Journal’s latest survey of economists say there is a 17% chance the U.S. will enter recession in the next year, the highest risk in three years. And 80% of forecasters said they see risks to the economy to the downside.

But if there’s reason for concern, there was no sign of distress in the US stock market yesterday. The S&P 500 surged nearly 1.7% on Thursday, albeit after previously falling sharply since the start of the year.

Leave A Comment