EUR/USD found support around 1.1170 area and rebounded to 1.1225 however resistance and sellers are keeping the pair contained. GBP/USD remained under pressure today after falling to 1.5138 yesterday. USD/JPY is also trading in familiar range with sellers at 120.50 and buyers waiting at support of 120.05 area. AUD/USD rally run out of steam after initial spike following the RBA decision to keep rates on hold.

Indices on the other hand continue their risk on mode despite very disappointing German factory orders data. GOLD is trading close to its 2 week high at 1139.70. Focus no shifts to the North American open, with hopes that some more volatility will be injected in the market.

Trading quote of the day:

funny thing about the stock market is that every time one buys, another person sells, and both think they are right.

“William Feather”

EURUSD

Pivot: 1.117

Likely scenario: Long positions above 1.117 with targets @ 1.1245 & 1.128 in extension.

Alternative scenario: Below 1.117 look for further downside with 1.1145 & 1.1115 as targets.

Comment: The RSI is well directed.

GBPUSD

Pivot: 1.52

Likely scenario: Short positions below 1.52 with targets @ 1.5135 & 1.5105 in extension.

Alternative scenario: Above 1.52 look for further upside with 1.5245 & 1.529 as targets.

Comment: The RSI lacks upward momentum.

AUDUSD

Pivot: 0.7055

Likely scenario: Long positions above 0.7055 with targets @ 0.715 & 0.718 in extension.

Alternative scenario: Below 0.7055 look for further downside with 0.7035 & 0.7 as targets.

Comment: The RSI is mixed to bullish.

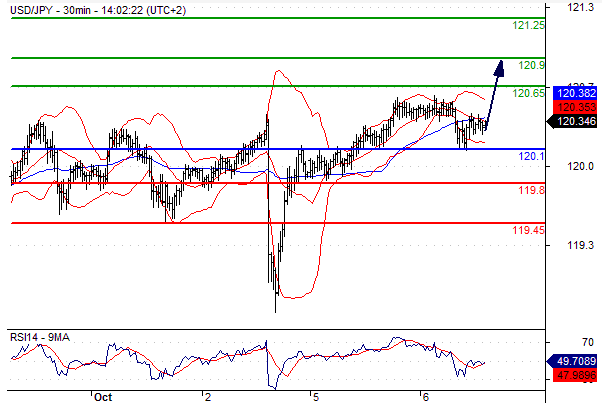

USDJPY

Pivot: 120.1

Likely scenario: Long positions above 120.1 with targets @ 120.65 & 120.9 in extension.

Alternative scenario: Below 120.1 look for further downside with 119.8 & 119.45 as targets.

Comment: The RSI is mixed to bullish.

USDCAD

Pivot: 1.314

Likely scenario: Short positions below 1.314 with targets @ 1.306 & 1.3 in extension.

Alternative scenario: Above 1.314 look for further upside with 1.318 & 1.321 as targets.

Comment: As long as the resistance at 1.314 is not surpassed, the risk of the break below 1.306 remains high.

Leave A Comment