It is a very volatile session in the EU today. EUR/USD spiked to 1.1250 highs following a break of the 1.1215 resistance level. Once again European indices are feeling the heat with German DAX trading -2% today which helped spark the EUR/USD rally. On the other hand GBP/USD and AUD/USD are being sold off relentlessly. USD/JPY is also under pressure (-0.74% on the day) so the combination of GBP weakness and JPY strength caused a collapse in GBP/JPY for the third straight day. Notable mover of the day though is USDCAD (+0.64%) which is posting multi year highs, last trading at 1.3413.

Fed’s Janet Yellen Speaks tonight, and she will have the opportunity to provide more clarity as to the future policy of the FED, something that she failed to do last week during the press conference. Her talk will be closely watched and will set the stage for further direction, at least for all USD denominated pairs.

Trading quote of the day:

“In this business if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

– Peter Lynch

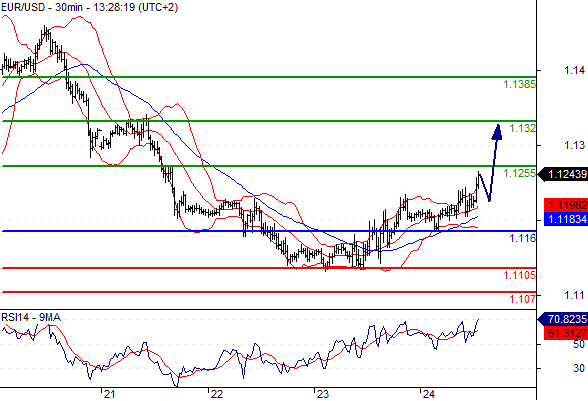

EURUSD

Pivot: 1.116

Likely scenario: Long positions above 1.116 with targets @ 1.1255 & 1.132 in extension.

Alternative scenario: Below 1.116 look for further downside with 1.1105 & 1.107 as targets.

Comment: The RSI is well directed.

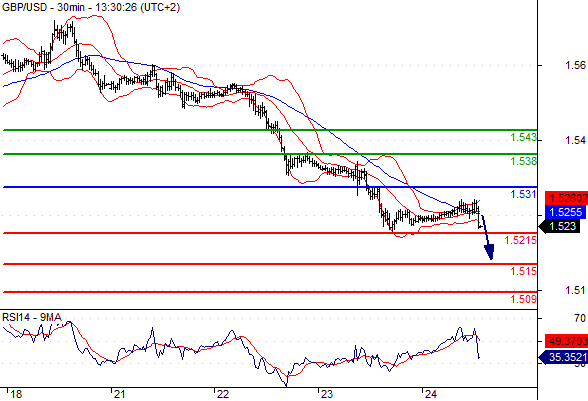

GBPUSD

Pivot: 1.531

Likely scenario: Short positions below 1.531 with targets @ 1.5215 & 1.515 in extension.

Alternative scenario: Above 1.531 look for further upside with 1.538 & 1.543 as targets.

Comment: As long as 1.531 is resistance, look for choppy price action with a bearish bias.

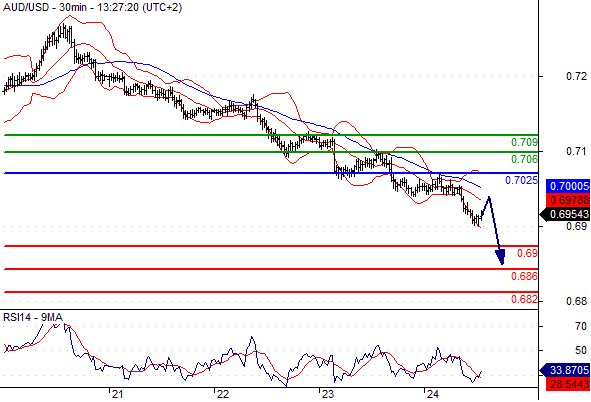

AUDUSD

Pivot: 0.7025

Likely scenario: Short positions below 0.7025 with targets @ 0.69 & 0.686 in extension.

Alternative scenario: Above 0.7025 look for further upside with 0.706 & 0.709 as targets.

Comment: The RSI is bearish and calls for further downside.

Leave A Comment