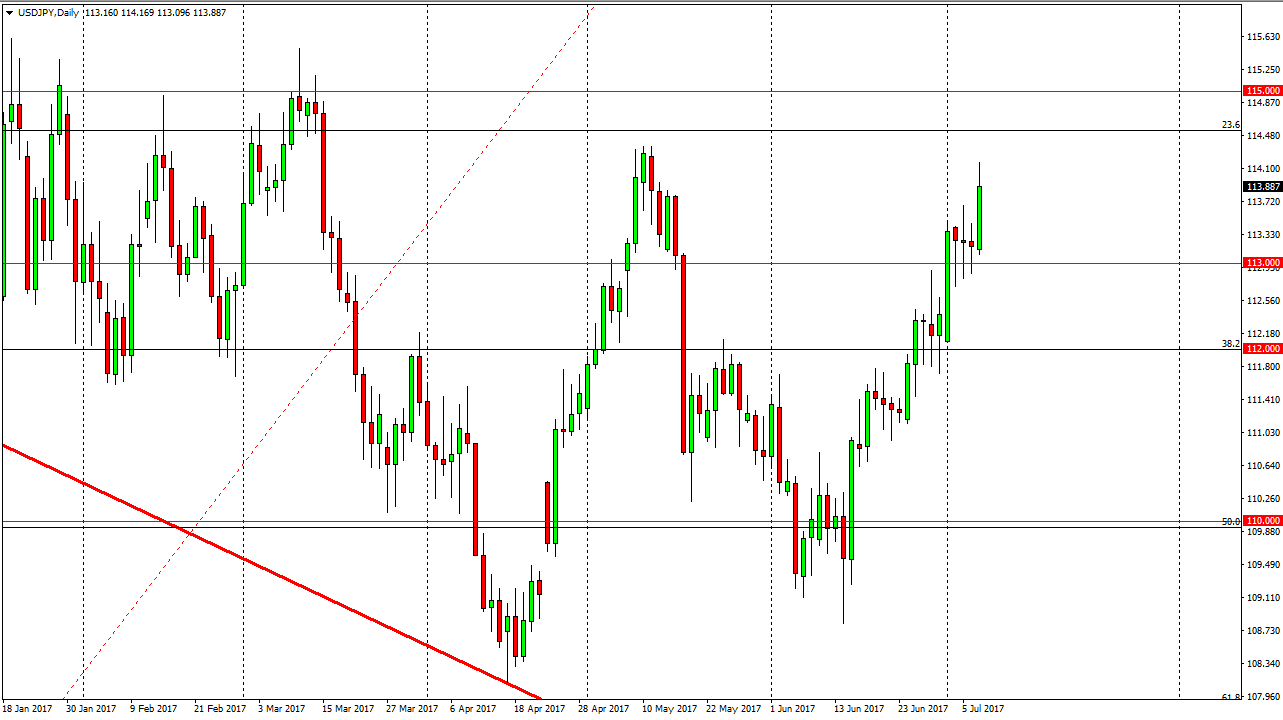

USD/JPY

The US dollar rallied during the day on Friday, as the jobs number was better than anticipated. This has the USD/JPY pair reaching above the 114 level. The market looks likely to pull back, but at this point I think there’s plenty of support near the 113 handle. The 115 level above is massively resistive, but ultimately if we can break above there, the longer-term uptrend will continue to the upside. I think that this is a “buy only” market, so I’m buying the dips as they appear. Even if we break down below the 113 handle, I think the 112-level underneath is even more supportive. The bond markets are starting to spread interest rates between these 2 a little bit wider, and that tends to favor the US dollar as US interest rates are rising while Japanese interest rates remain ultralow.

AUD/USD

The Australian dollar initially tried to rally during the day, but turned around at the 0.7625 level to turn around to form a bit of a shooting star. I think there is plenty of support below though, so I’m not necessarily interested in trying to short this market yet though, because I think there’s plenty of support near the 0.7550 level. Ultimately, the market looks likely to continue to be volatile, but I think that the markets will focus on a lot of different things, not the least of which is gold which seems to be very soft. If we broke above the top of the range for the day on Friday though, I think that’s a very bullish sign and we could go to the 0.77 handle. Either way, I think this is a very volatile market and quite frankly I’m not overly interested in putting a lot of money into the Australian dollar as the central bank is essentially very neutral.

Leave A Comment