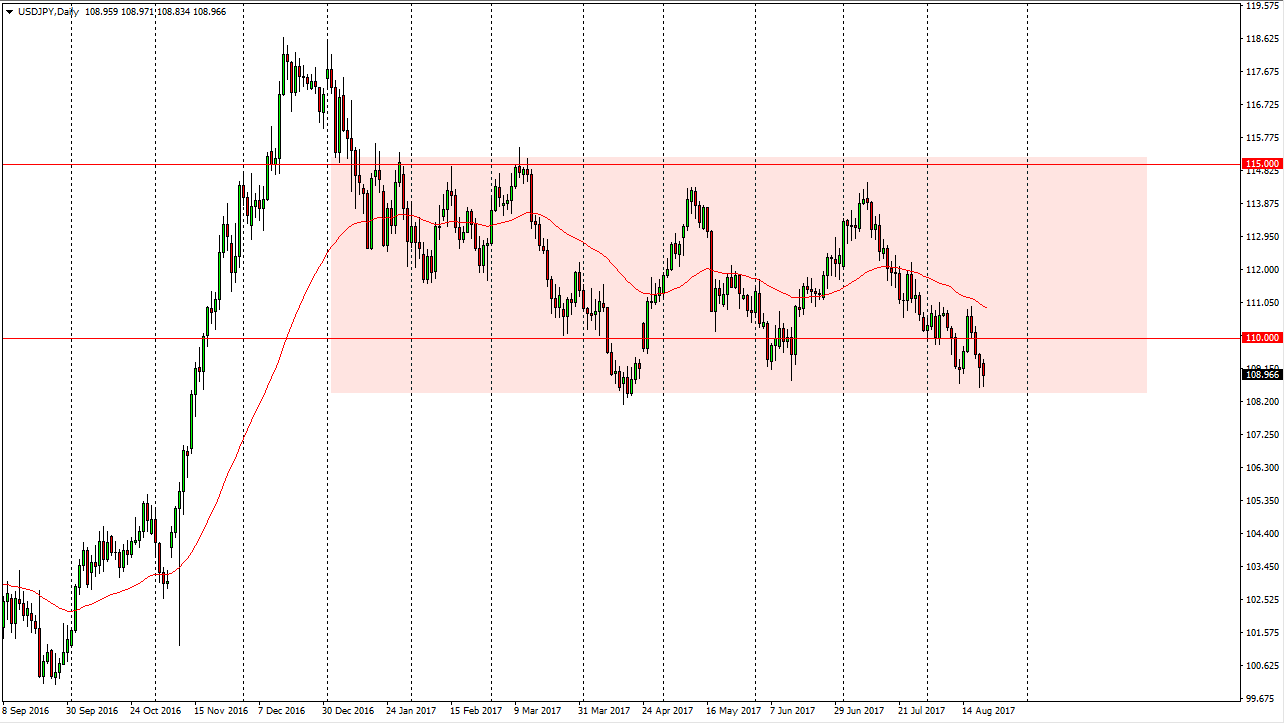

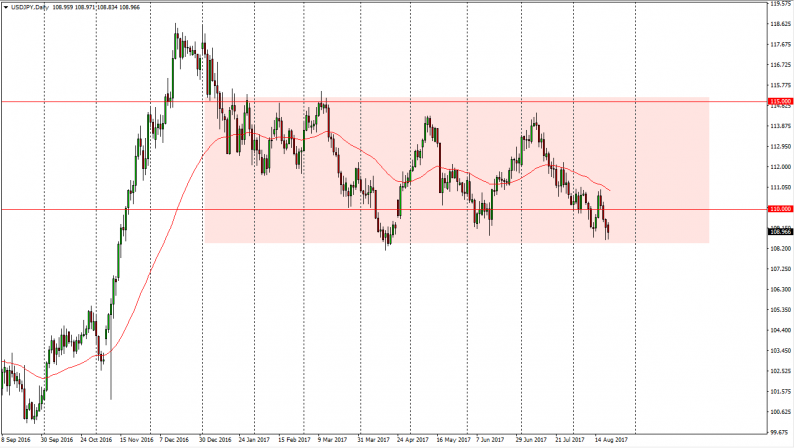

USD/JPY

The US dollar fell a bit during the day on Monday but continues to find the 108.50 level to be supportive. Because of this, I am not comfortable shorting this market until we clear that level to the downside, and on a daily close. If we did breakdown below there, the market should then go towards the 105 level over the longer term. Alternately, if we can break above the 111 level, that would be a very bullish sign, and should send this market looking towards the 115 level. Remember, this pair is highly sensitive to risk appetite, so pay attention to the overall attitude of financial markets around the world. In stock markets rise, then typically this pair does reasonably well. We will have to see what interest rate expectations look like by the end of the week, with so many central bankers meeting at Jackson Hole. I do think there’s a good chance of a bounce, but I would wait for a daily close to make any type of trading decision.

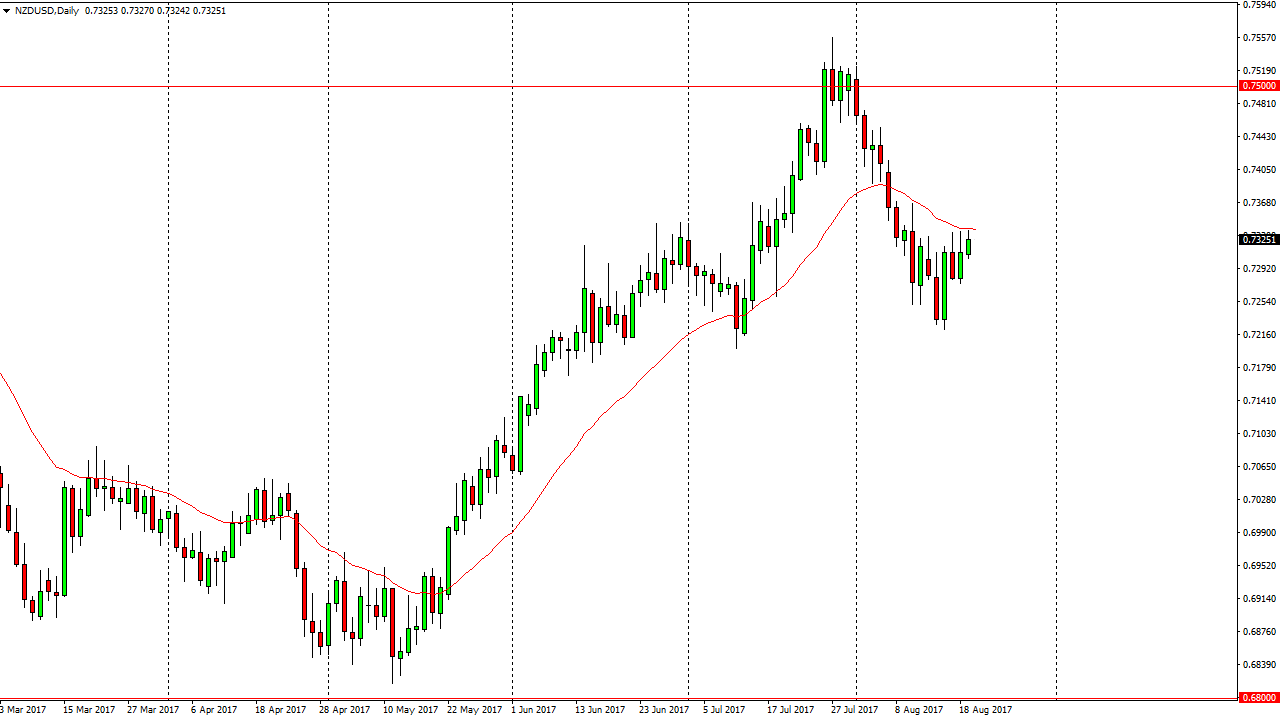

NZD/USD

The New Zealand dollar rallied a bit during the day on Monday, testing the 0.7350 level. If we can break above there, I believe that the market should then go to the 0.75 handle, and perhaps even break above there and continue to go higher. I think that the 0.7225 level underneath should be massively supportive, and with that being the case, I think that there is plenty of reason to think that the support should continue. This is especially true with the New Zealand dollar being a higher yield are than the US dollar, and of course the risk appetite out there looking somewhat bullish should help this commodity currency as well. If we break down below the 0.72 handle, then I think the market would probably go looking towards the 0.70 level.

Leave A Comment