V.F. Corporation (VFC – Free Report) reported better-than-expected earnings and revenues for the transition period, ended Mar 31, 2018. This marked the company’s third top- and bottom-line beat in the last four reports.

The company’s adjusted earnings per share of 67 cents improved 30% year over year and beat the Zacks Consensus Estimate of 65 cents. Earnings per share included a 3 cents contribution from the Williamson-Dickie acquisition.

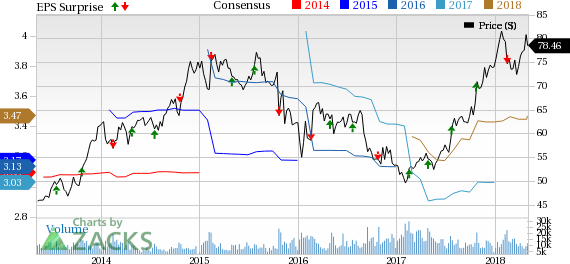

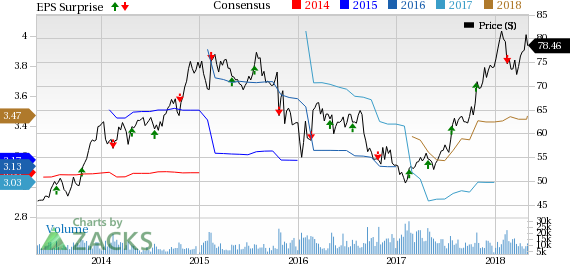

V.F. Corporation Price, Consensus and EPS Surprise

V.F. Corporation Price, Consensus and EPS Surprise | V.F. Corporation Quote

V.F. Corp generated total revenues, including royalty income, of $3,045.4 million that increased about 22% year over year and surpassed the Zacks Consensus Estimate of $2,902 million. Net sales of $3,022.9 million also advanced 22% from the prior-year quarter, including contributions from the Williamson-Dickie acquisition. On a currency-neutral basis, revenues jumped 17%.

Excluding the Williamson-Dickie acquisition, revenues were up 12% while currency-neutral revenues grew 8%. The revenue growth is attributed to continued strength in the company’s international and direct-to-customer platforms, and Outdoor & Action Sports coalition.

Adjusted gross margin expanded 50 basis points (bps) to 50.8%, thanks to a favorable mix-shift toward high-margin businesses. Excluding the Williamson-Dickie acquisition, adjusted gross margin expanded 160 bps to 51.9%. Gross-margin growth was partly negated by Williamson-Dickie acquisition and foreign currency headwinds. Notably, foreign currency hurt gross margin by 20 bps.

Adjusted operating income rose 14% to $330 million while the adjusted operating margin contracted 80 bps to 10.8%. Excluding Williamson-Dickie, adjusted operating margin contracted 40 bps to 11.2%. Operating margin included 20 bps positive impacts from foreign currency.

Overall, this Zacks Rank #3 (Hold) stock has decreased 0.2% in the last three months against the industry’s growth of 8.3%.

Leave A Comment