Venezuela’s anti-government protests are growing increasingly violent, with the death toll from clashes between protesters and government forces that began in May topping 100. Despite the country’s increasing political instability, and US President Donald Trump’s half-serious threats of an invasion, President Nicolas Maduro has decided to press ahead with his vote to create a rubberstamp constituent assembly that will allow him to amend the country’s constitution.

With the country’s finances looking ever more precarious, Bloomberg warns that that this decision could bring about the first collapse of a sovereign oil producer. Venezuela has the largest natural oil reserves of any country on Earth, yet the decline in oil prices that began in 2014, coupled with years of economic mismanagement, have been enough to bring the country’s economy to its knees.

“We may be about to see the first sovereign producer to unequivocally fail. The oil producer in question is Venezuela, and that assessment comes courtesy of Helima Croft, who is global head of commodity strategy at RBC Capital Markets and formerly worked with both the Council on Foreign Relations and the CIA. In a global oil market mired in excess inventory and low expectations, Venezuela is the most tangible of wildcards. Its tragic and volatile mix of a failing, oil-dependent economy, political gridlock and simmering unrest is well known at this point.But things are building to a head, partly due to the relentless logic of the bond market and partly due to the more proprietary logic of U.S. foreign policy.”

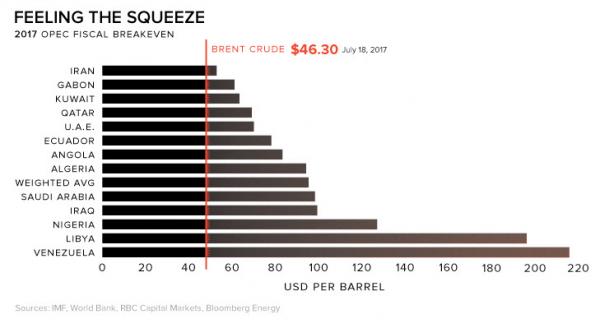

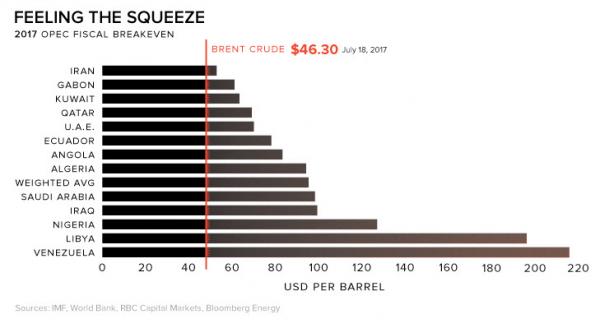

While many oil dependent nations are working to diversify or ride out low oil prices in other ways, it seems unlikely that the crisis in Venezuela will be reversed anytime soon. Here’s the full fiscal breakeven needed by OPEC producers, including Venezuela, to help normalize things:

The country’s fate, as Bloomberg explains, is largely tied up in the bond market, where yields on Venezuelan bonds recently soared to 36% as Maduro renewed his calls to rewrite the Constitution. With the US threatening sanctions, investors are worried that the situation could reach a crisis point by Christmas.

Leave A Comment