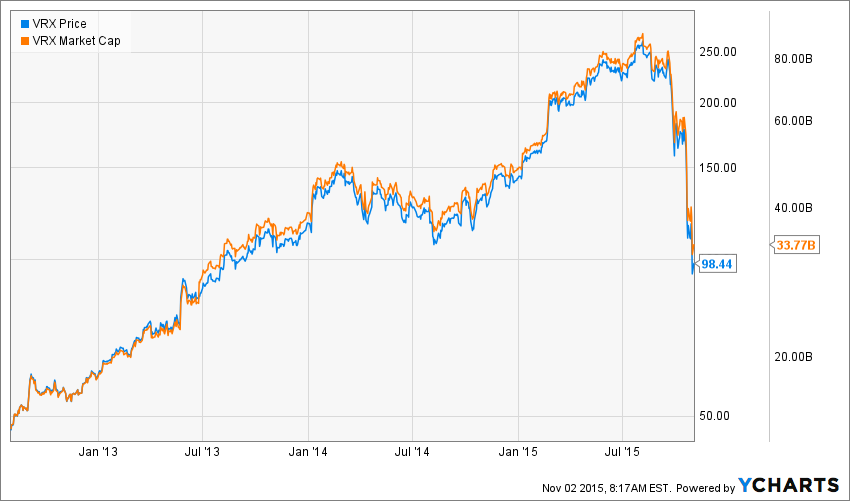

If you need evidence that Wall Street is a financial time bomb waiting for ignition look no further than the recent meltdown of Valeant Pharmaceuticals (VRX). In round terms, its market cap of $90 billion on August 5th has suddenly become the embodiment of that proverbial sucking sound to the south, having plunged by nearly two-thirds to only $34 billion by Friday’s close.

Click on image to enlarge

No, Valeant was not caught selling poison or torturing cats during the last 90 days. What is was doing for the past six years is aggressively pursuing every one of the financial engineering strategies that are worshipped and rewarded in the Wall Street casino.

Indeed, Valeant’s evolution during that period arose straight out of financial engineering central. That is, it was a creature of Goldman Sachs and the various dealers, underwriters, hedge funds and consulting firms which ply the Bubble Finance trade.

At the end of the day, the latter have turned the C-suites of corporate America into gambling dens by attracting, selecting and rewarding company wrecking speculators and debt-crazed buccaneers to the top corporate jobs.

In this case, the principal agent of destruction was a former M&A focussed McKinsey & Co consultant, Michael Pearson, who became CEO in 2008.

Pearson had apparently spent a career in the Dennis Kozlowski/Tyco school of corporate strategy. That is, advising clients to buy, not build; to slash staff and R&D spending, not invest; to set ridiculously ambitious “bigness” goals such as taking this tiny Canadian pharma specialist from its $800 million of sales to a goal of $20 billion practically overnight; to finance this 25X expansion with proceeds from Wall Street underwriters, not internally generated cash. He even replicated the Tyco strategy of moving the corporate HQ to Bermuda to slash its tax rate.

Pearson’s confederate in this scorched earth corporate “roll-up” enterprise was Howard Schiller, a 24-year veteran of Goldman Sachs, who became CFO in 2011, and soon completed the conversion of Valeant into a financial engineering machine.

During their tenure, Pearson and Schiller spent about $40 billion on some 150 acquisitions. At the same time, they militantly eschewed investment in drug research and development in an industry who’s very purpose is the development of new drugs and therapies.

Yet the alternative strategy they peddled to the occupants of the hedge fund hotel that became increasingly crowded with VRX punters as its shares soared skyward was downright nonsensical and economically vapid. It could only have thrived during the late stages of a Bubble Finance mania.

In essence, Pearson and Schiller claimed that the rest of the industry was infinitely stupid, and that tens of billions of market cap could be created instantly by the simple expedient of buying companies with seasoned drugs and then jacking up prices, often by orders of magnitude.

Leave A Comment