We know it’s hard to believe, but we’ve closed out the first week of 3Q 2107. For some, it was a vacation week, for others like those of us here at Tematica it was a busy one. As much as we love a holiday, especially July 4th, the downside is compressing five days of trading, data and other information into what was essentially three days.

It was a busy week from start to finish and ended with the market indices eking out a modest move higher, due primarily to Friday’s better than expected June Employment Report.

You can’t continue to get all this job growth but there is no wage pressure. So something is not adding up at all,”

JJ Kinahan

Chief Market Strategist , TD Ameritrade (AMTD)

The headline jobs figure crushed expectations and job creation figures for April and May were revised higher. Average hourly wage growth, however, in June trailed forecasted levels and May was revised modestly lower. We’d also note that despite the upside surprise jobs number in the June report, the 12-month employment growth rate is still hovering around 1.5 to 1.6 percent, which serves as a reminder the current expansion is getting long in the tooth. All in all, the June Jobs Report was solid, but one that is not likely to lead the Fed to boost interest rate near-term, especially since it’s looking more like it will begin to unwind its balance sheet come September.

Also released on Friday was the Fed’s latest Monetary Policy Report, which added firepower for the Fed to hold steady near-term with regard to interest rates. Specifically, inside the report we found, “Economic activity increased at a moderate pace over the first half of the year” and “on balance, current and prospective economic conditions called for a further gradual removal of policy accommodation.”

To us, this signals that we’re not likely to see the next Fed rate hike until late this year, and possibly even early 2018 at the soonest. Over the coming weeks, we’ll continue to get additional June data points, which should give us more insight for the speed of not only the second quarter but what’s likely to be the start of the third quarter.

So, Magic 8 Ball, Are We Heading into a Recession?

Although we see no signs of an imminent end to this economic cycle, we would remind investors that we are more than eight years into the second-longest bull market in history. On top of that, we’re seeing classic late-cycle signs everywhere — from elevated stock valuations, a flattening yield curve, levered balance sheets and an increasingly hawkish Fed.

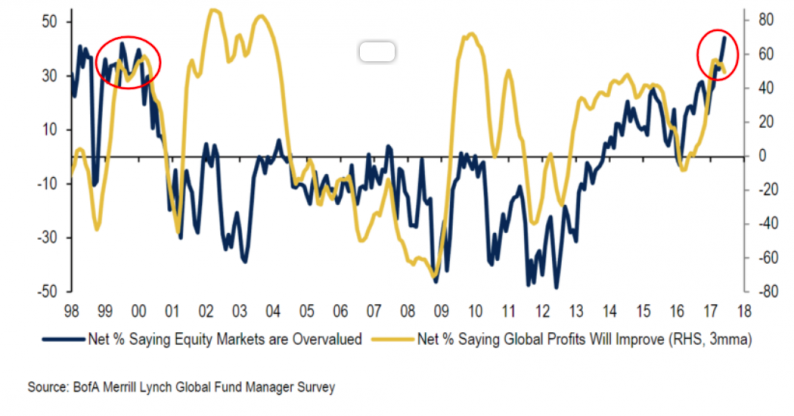

Let’s not forget the herd optimism among the Wall Street analyst community, which more often than not tends to be a few beats late on the dance floor. The Bank of America Merrill Lynch’s “Sellside Indicator”, which measures how bullish strategists are on US equities, rose to its highest level since 2011 in June. That compares to the record 44 percent of fund managers that said they saw equities as overvalued in June per the monthly Bank of American Merrill Lynch institutional investor sentiment poll. We’d note not only the sequential increase from 37 percent but also the reading is the highest since the 1999-2001 period.

Leave A Comment