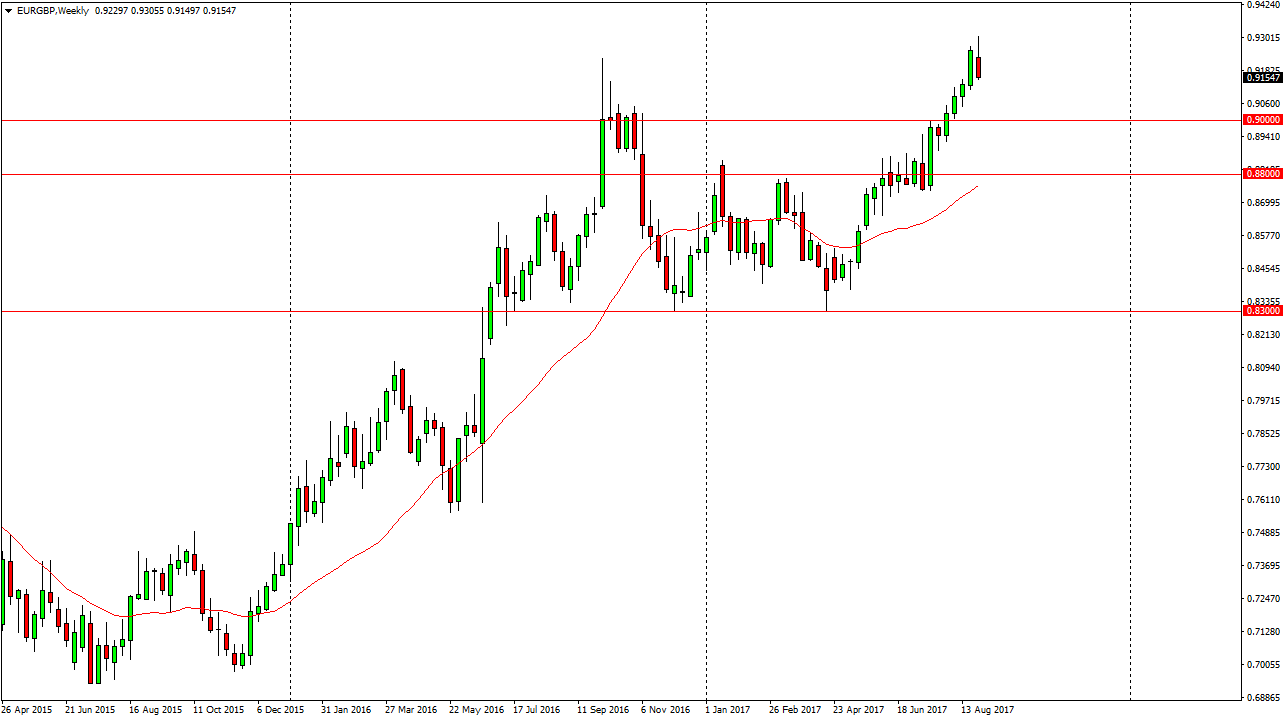

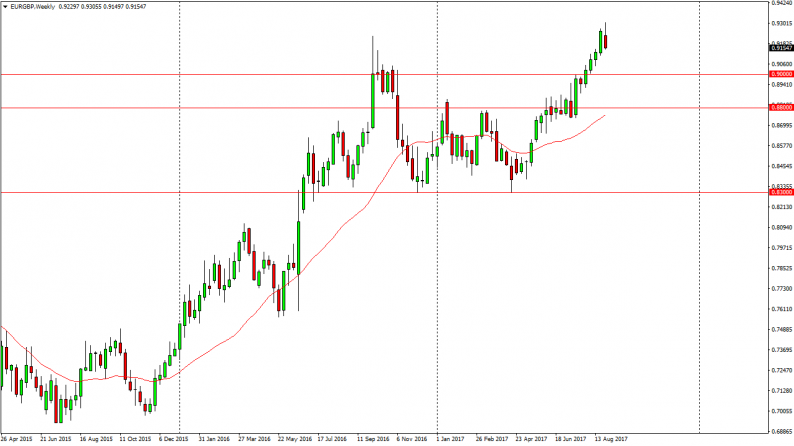

EUR/GBP

The EUR/GBP pair broke to a fresh, new high during the week but turned around to form a rather negative candle. By doing so, it looks as if we could pull back from here, perhaps looking for support underneath. I think that the 0.90 level underneath will be that support, so we may get a little bit of softness and what has otherwise been a very strong uptrend. Do not look to sell this market, simply look for value at lower levels.

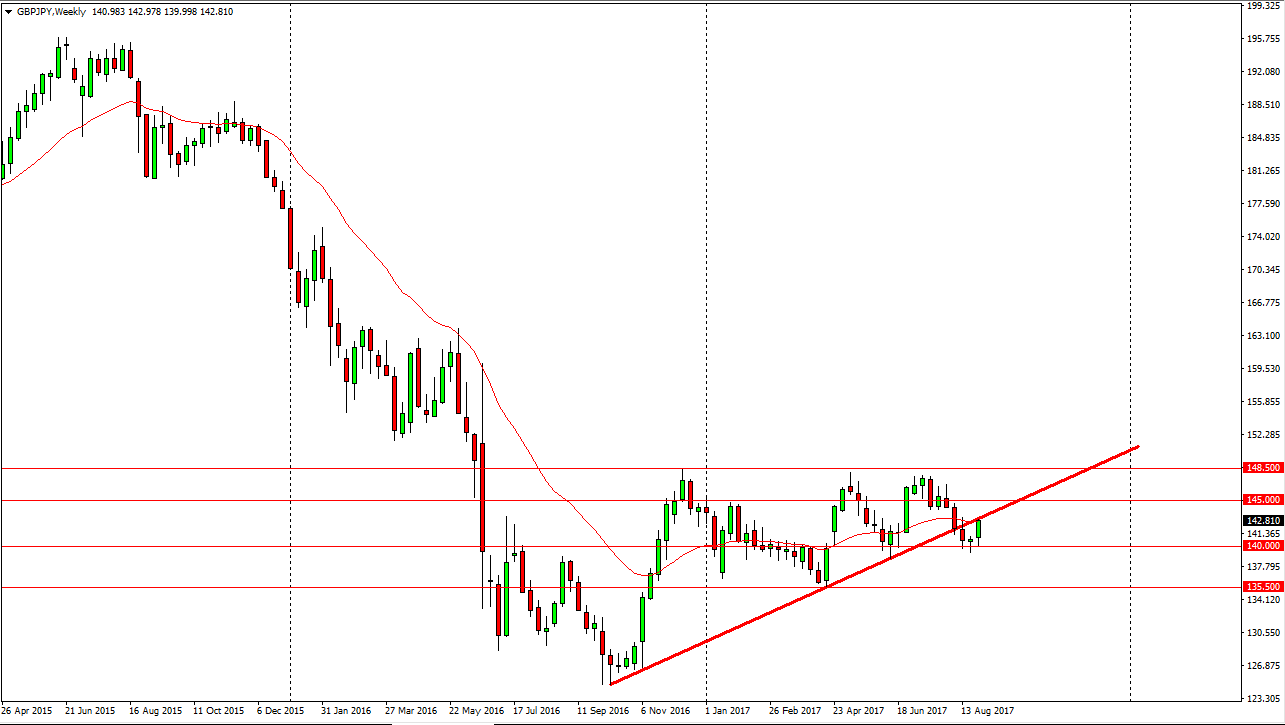

GBP/JPY

The GBP/JPY pair bounced during the week, using the 140 level as support. We are pressing the underneath of the uptrend line that broke a couple of weeks back, so I think this week will be vital. If we can clear above the 143 level, I think the market goes to the 145 level, and then the 148 level. If we pull back from here, watch the 140 handle, a breakdown below there would be negative.

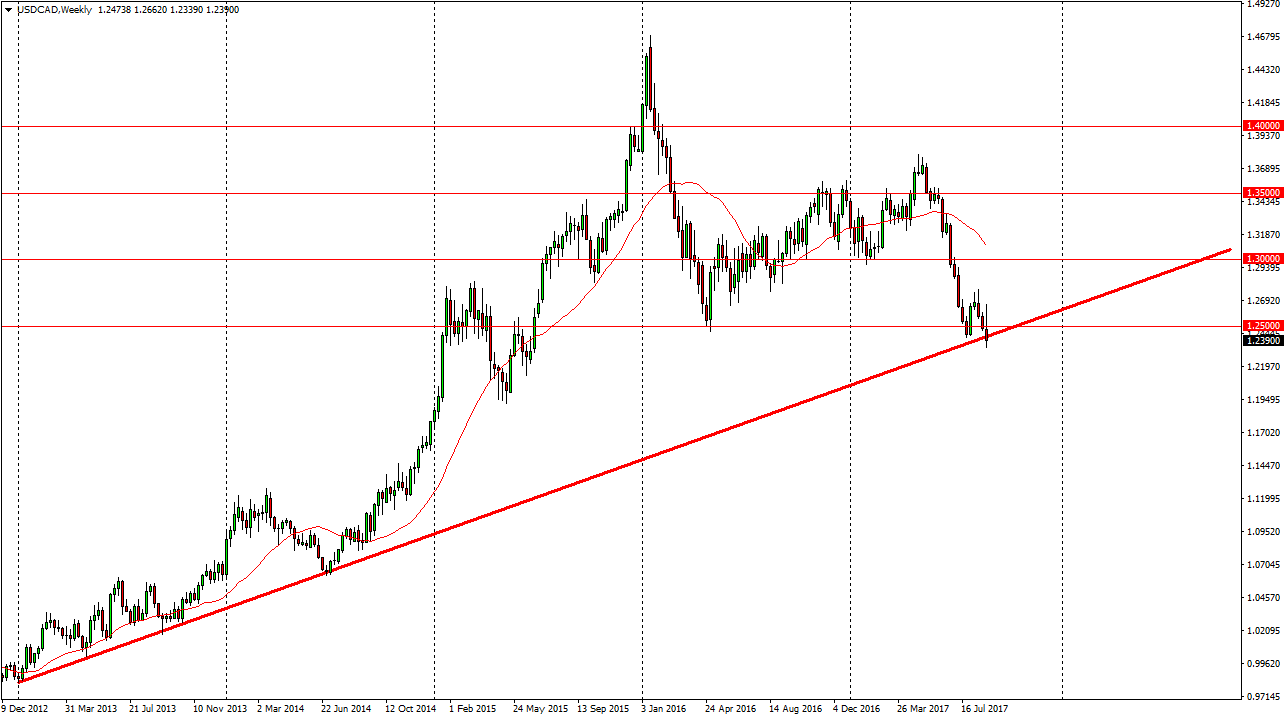

USD/CAD

The US dollar initially rallied against the Canadian dollar, but the strong GDP numbers coming out of Ottawa since this market much lower. Any rally at this point in time looks suspicious, because the week has formed a massive shooting star sitting on top of a massive uptrend line. It is more than likely a sign that we are about to break the uptrend line significantly, and therefore could go looking towards the 1.20 level very suddenly.

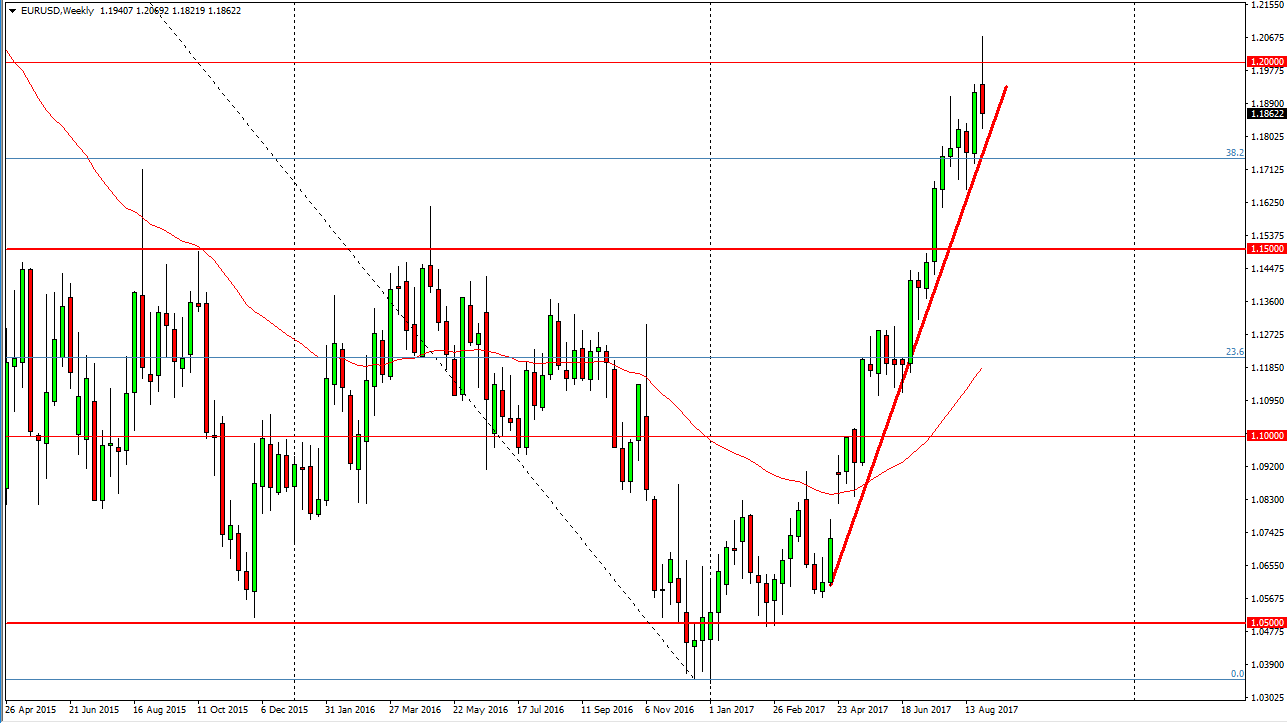

EUR/USD

The EUR/USD pair rallied during the week, breaking above the 1.20 level. However, we have turned around to form a very negative candle, and the shooting star should send this market lower. However, there is a significant amount of support underneath so it’s only a matter of time before the buyers get involved. Currently though, I think letting this market fall before putting money into it is probably the way to go.

Leave A Comment