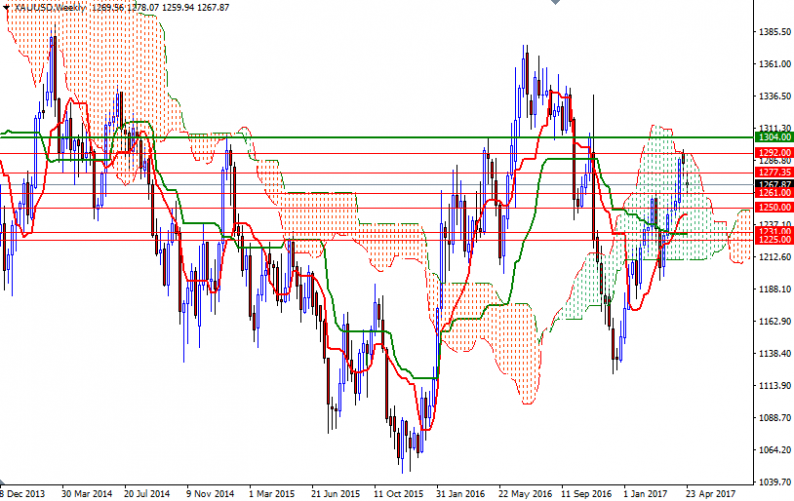

Gold logged a second straight weekly loss on Friday as a series of upbeat earnings reports bolstered appetite for risk. Global equity markets ended the week higher after the results of the first round of the French presidential elections eased concerns about the future of the euro zone and corporate earnings showed sustained strength among U.S. companies. Although the market felt pressure from various factors, the support at the 1261 level held the market and limited the potential downside.

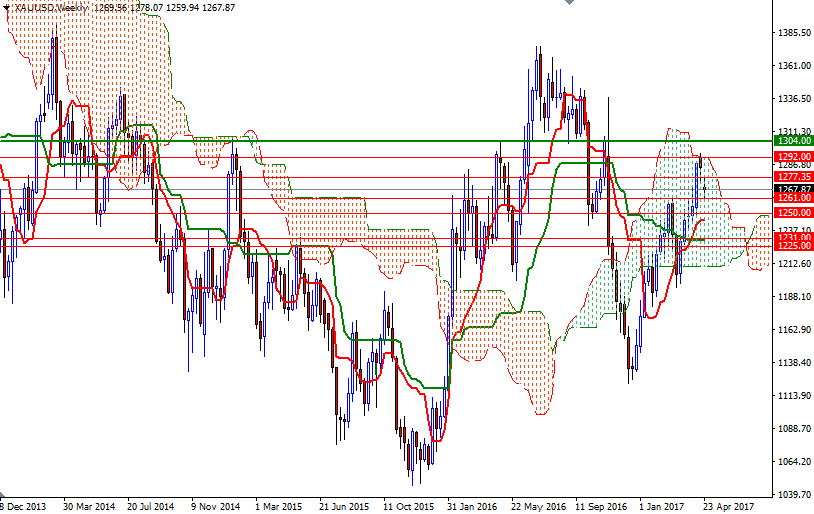

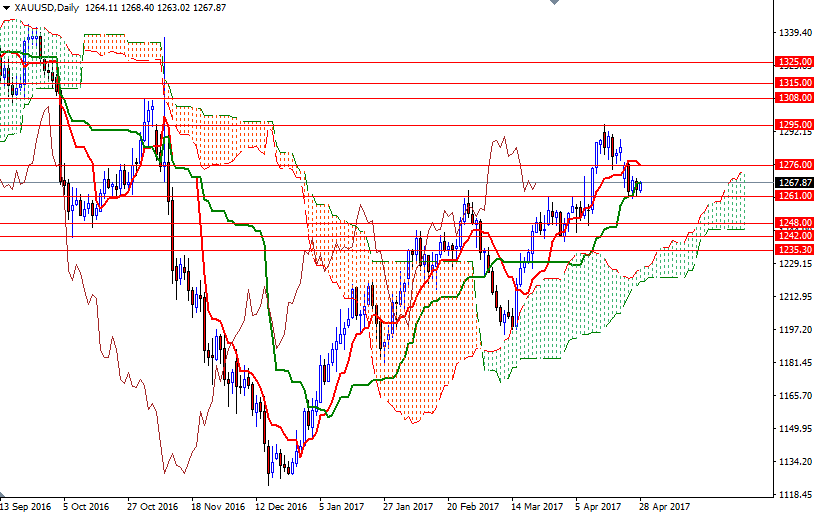

Trading above the daily Ichimoku cloud, along with positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on the weekly and daily charts, suggests that lower prices will continue to attract buyers. However, since prices still remain below the 4-hourly and within the borders of the weekly cloud, I wouldn’t eliminate the possibility of a move towards 1250/48. But of course, in order to reach there, the bears will have to drag prices below the 1261 region. On its way down, support may be found in the 1257/5 area. A successful break below 1248 could see a fall down to 1242/0.

The initial resistance level stands at 1270.60, followed by 1277.35-1276, where the daily Tenkan-sen resides. If the market anchors somewhere above 1277.35, then it is likely that the market will head towards the 1295/2 zone, the top of the weekly cloud. Closing beyond 1295 could trigger a push up to 1308/4, which is the next solid resistance on the charts.

Leave A Comment