Stocks managed a mid-day rebound from a 566-point decline in the DJIA. Among the suggested reasons was more help from central bankers. With a light economic calendar, I expect Fed speculation to compete with earnings in the week ahead. Everyone will be wondering:

Will the Fed signal a dovish tilt?

Prior Theme Recap

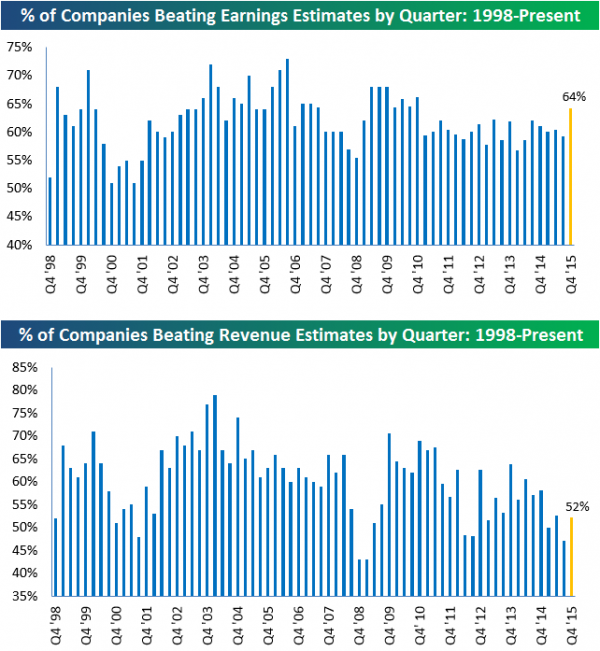

In my last WTWA I predicted that everyone would be watching earnings reports carefully, wondering if they could provide a floor for stocks. There was indeed a lot of attention to earnings, but that news did not seem to support the stock market. The stock rebound coincided with a mysterious rally in oil. (Could some really have been confused by the shift from the expiring front month contract? Really??) You can see the mixed story for stocks from Doug Short’s weekly chart. (With the ever-increasing effects from foreign markets, you should also add Doug’s weekly chart to your reading list).

Doug’s update also provides multi-year context. See his weekly chart for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

There is a fairly light economic calendar this week, featuring the FOMC decision on Wednesday. Despite the continuing flow of earnings reports, speculation about the Fed will dominate market discussion until after the meeting. Everyone will be wondering –

Will the Fed signal a dovish tilt?

No one expects a change in rates at this Fed meeting, but the language in the statement will be carefully parsed for signs that the path of future increases will be less aggressive. Here are the key viewpoints:

You will see vigorous proponents for each of these viewpoints.

As always, I have my own opinion in the conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

On balance the news was pretty good last week.

The Bad

Some of the economic data was disappointing.

Leave A Comment