Photo Credit: Mike Mozart

Finish Line, Inc. (FINL) Consumer Discretionary – Specialty Retail | Reports March 24, Before Market Opens

Key Takeaways

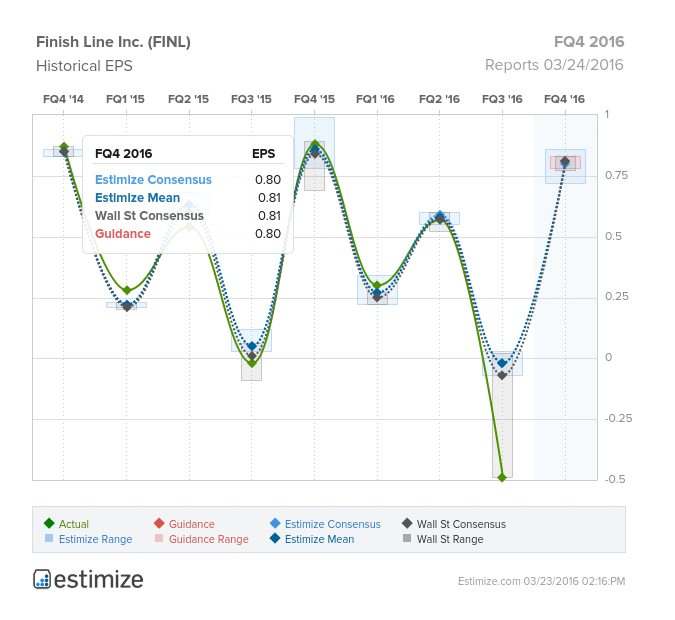

Retail footwear chain, Finish Line, is scheduled to report fourth quarter earnings tomorrow, before the opening bell. Investors are hoping the retail company can recover the losses from its abysmal third quarter but realistically, expectations have been tepid. The Estimize consensus calls for EPS of $0.81, 1 cent below Wall Street, with revenue expectations of $569.23 million, about $2 million less than the Street. The Select Consensus on the other hand, is expected a modest loss of 1 cent on the bottom line and 2 million in sales. The Estimize community has maintained a pessimistic stance on profitability, revising EPS estimates down 18% in the past 3 months and 5% in the past month. It comes as no surprise that current estimates forecast a 9% YoY decline on the bottom line while sales are looking to rise a meager 3%.

Finish Line is coming off a rough third quarter in which it missed on both the top and bottom line by a mile. Both Estimize and Wall Street had expected marginal losses in the the single digits for the quarter, but ultimately Finish Line posted EPS of -$0.49 and missed on the top line by $20 million. As a result, shares have taken a beating, falling 26.8% in the past 6 months. The company’s third quarter performance was severely impacted by a disruption in its supply chain following the implementation of a new enterprise management system. Finish Line ended the quarter with net sales decreasing 3.5% on a YoY basis and comp sales down 5.8%. One way FINL intends to improve profitability is by shutting the doors on 150 of its worst performing stores, or 25% of its store base, in the next 4 years. On the competitive front, Sports Authority’s recent bankruptcy creates some customer acquisition opportunities for Finish Line, but Foot Locker still remains the biggest threat. Finish Line maintains a sound balance sheet, ending the most recent quarter with no interest bearing debt and $55.3 million in cash and cash equivalents.

Leave A Comment