US growth, such as it is, has lately been driven by a handful of hot sectors. Car sales have set records, high-end real estate is generally way up, and federal spending – based on last year’s jump in the national debt – is booming.

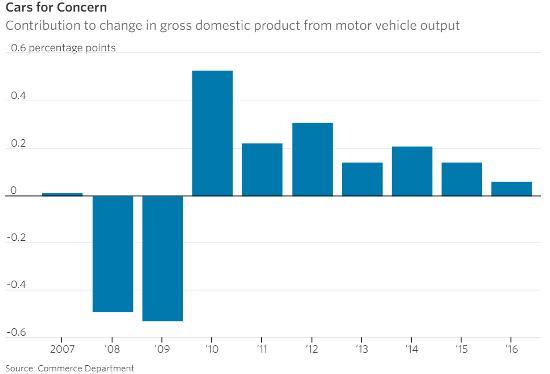

But now the private sector part of that equation is shifting into low gear. Cars in particular:

Economy Will Miss That New-Car Smell

(Wall Street Journal) – The annual pace of light-vehicle sales fell to a seasonally adjusted 17.2 million in the first quarter from 18 million. That the decline has come despite generous incentives from car companies and still-low gasoline prices suggests that sales are past their peak.

The upshot is that the deferred purchases that helped bolster business coming out of the recession have been made, and it will be up to replacement demand and a slowly growing population of registered drivers to fuel auto sales. If car makers are lucky, sales might stay on their recent level. If they aren’t—and the recent drop in used-car prices raises that prospect—the trend could be lower. In either case, autos might count as a negative for consumer spending and the industry, a big driver of economic growth, could be an outright drag on the economy for the first time since 2009.

—————————-

GM Joins Ford Worrying About Declining Used-Car Prices

(Bloomberg) – General Motors Co. said a glut of used cars will return to market after their leases expire and drag on its finance unit this year, following similar warnings by peer Ford Motor Co. and lenders such as Ally Financial Inc.

The prices of used cars in GM Financial’s leasing portfolio will decline about 7 percent this year, GM Chief Financial Officer Chuck Stevens said on a conference call with analysts Thursday. The value of used GM vehicles have depreciated faster than expected in the first quarter, particularly with crossovers, and prices will fall as much as 3 percent next year.

Leave A Comment