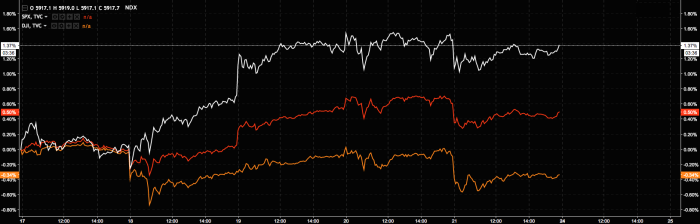

Stocks hit records this week although equities were uninspired on Friday as a slump in crude and concerns about Trump weighed on sentiment.

The VIX gave double-digits a try, but decided that ultimately, a 9-handle is better:

10Y yields have moved steadily lower since Yellen’s dovish lean on Capitol Hill with lackluster data, the expanding Mueller investigation, and the failure of the GOP healthcare bill all taking their toll on the outlook for reflation in the US:

The 2s10s steepened after Sintra but is back to flattening:

But hey, at least CTAs got some much needed relief.

Relatedly, the MOVE hit a record low:

And you should note the trend in rate differentials:

Chipotle shares collapsed to their lowest levels since 2013 as investors seem concerned that the company’s latest combo meal offering, “Norovirus with a side of live mice,” isn’t going to be a big hit with diners:

Netflix was the star, so you know… “chill”…

GE weighed on the Dow Friday after disappointing earnings projections:

Financials were laggards with one notable exception (spot the odd one out):

Oil should have had a good week (Brent topped $50 at one point), but bullish inventory data and Saudi “hope” were ultimately overshadowed by jitters about rising production and, more dramatically, a veritable gut punch on Friday morning when Petro–Logistics said OPEC supply in July expected to exceed 33 million barrels a day, highest since December 2016:

“We have the OPEC meeting in Russia on Monday and that’s going to be top of mind,” Dan Katzenberg, Senior Exploration and Production analyst at Baird said today.

“The meeting gathers several ministers from OPEC and non-OPEC member countries in St. Petersburg,” Reuters reminds you. “Kuwaiti Oil Minister Essam al-Marzouq, whose country heads the joint ministerial committee, said attendees would discuss continuing the production cuts.”

Leave A Comment