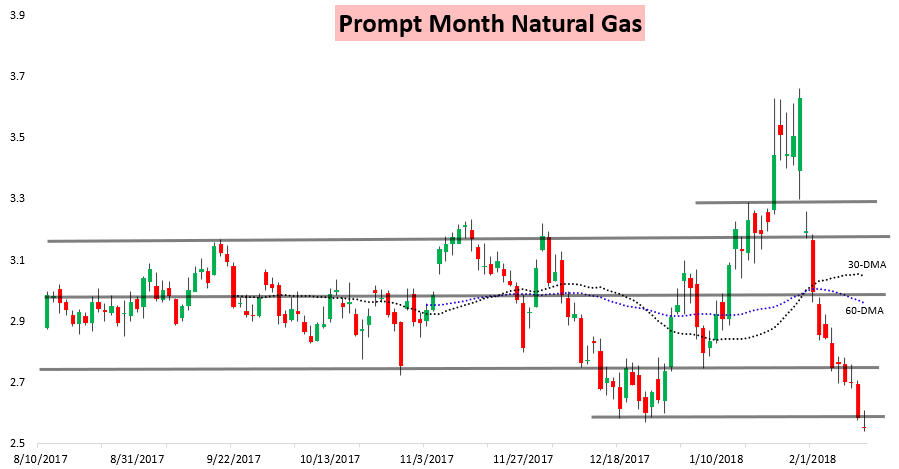

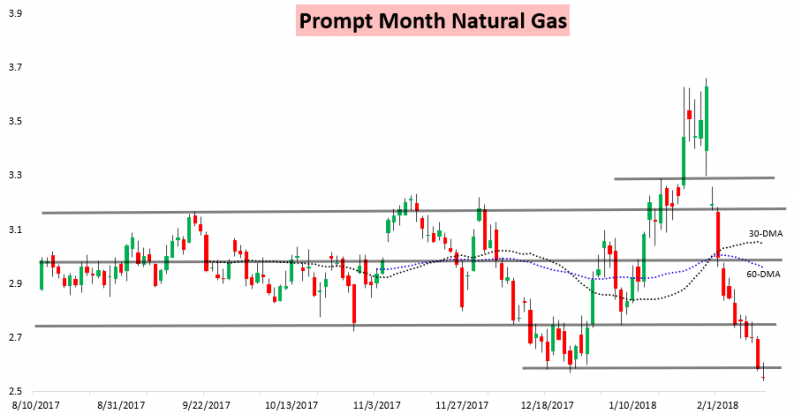

March natural gas prices settled lower by a bit over a percent today on a day that felt far more like spring than winter trading. The March contract has now logged losses on 8 of the last 9 trading days.

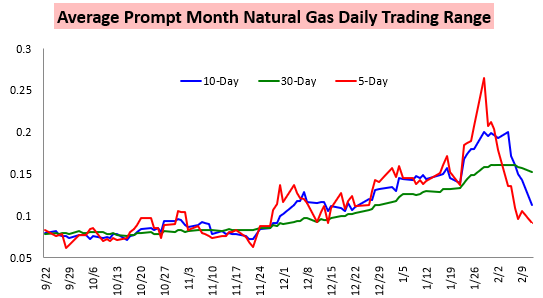

Prices also saw the smallest trading range since December 11th at only 6.9 cents on the day. This has pulled the average prompt month trading ranges far lower again.

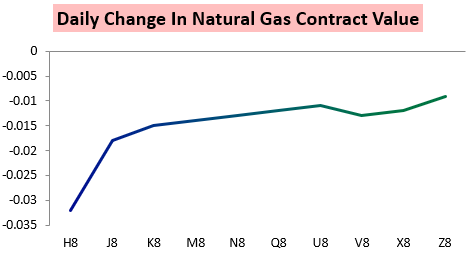

As would be expected following weekend GWDD losses, the March contract lagged the most through the day today, with the rest of the strip a bit more firm.

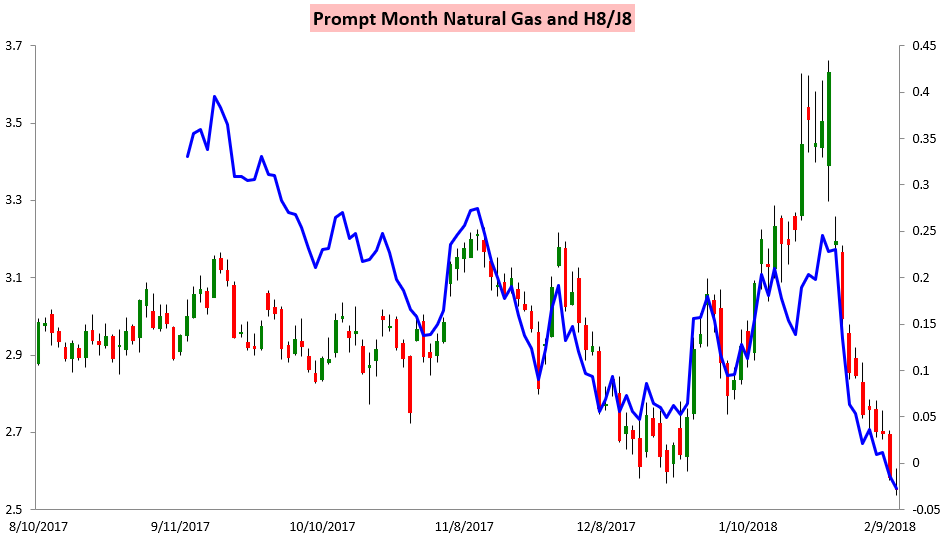

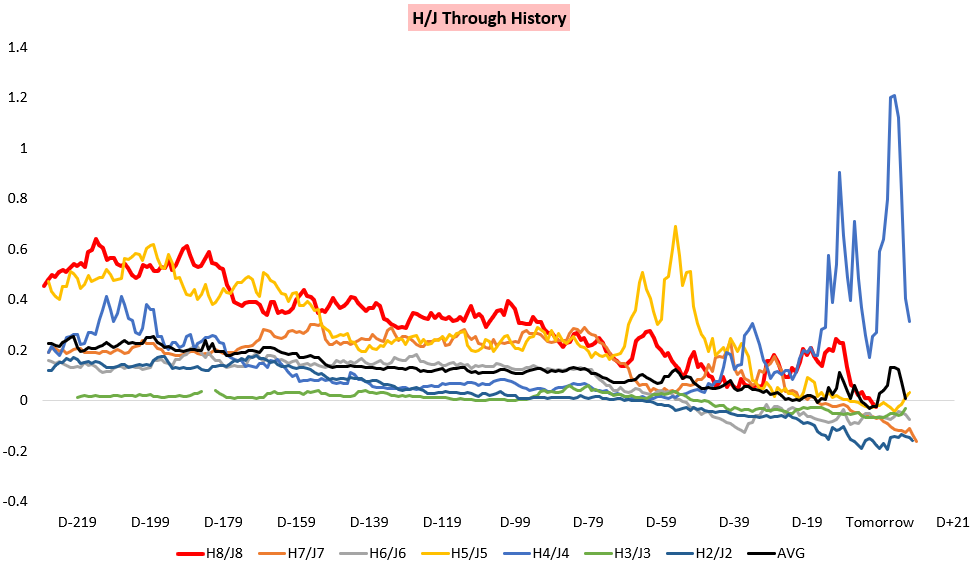

The result was a new low settle for the H8/J8 spread.

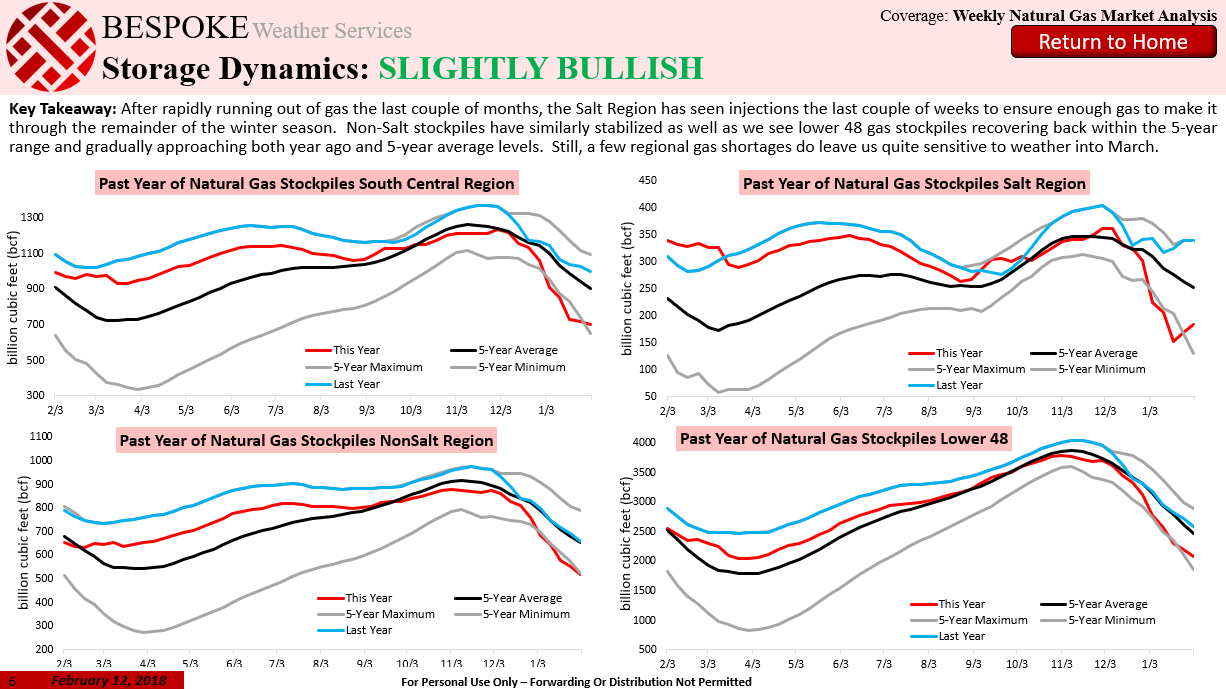

This comes even with storage levels remaining at rather low levels. In our Natural Gas Weekly Update, which we provide for subscribers every Monday and covers all aspects of the natural gas market, from current and future weather expectations to fundamental and technical analysis, we included new charting on regional storage levels.

The report includes a detailed summary of our natural gas sentiment for the week, letting traders see which way weather and other fundamental and technical factors appear to skew risk. Here we combine our knowledge of natural gas spreads with our knowledge of weather model biases to help traders plan for the coming week. This joins our Note of the Days in integrating this multi-faceted analysis, including charts like the one below that look at historic spread pricing (and show why the title of this blog is pricing out the winter premium).

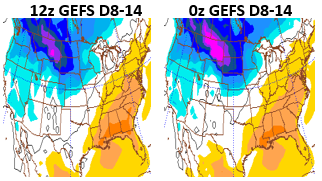

That can help us determine how important recent shifts in weather models can be, such as the afternoon American GEFS which trended slightly warmer across the Southeast in the long-range (images courtesy of the Penn State E-Wall).

Leave A Comment