I wanted to start the New Year off with a solid base. The recent discussions I’ve had with friends over the Holidays made me realize how sometimes we complicate our lives for nothing. After 13 years of investing for my own portfolio and working in the financial industry, I know that the “flavor of the month” is different each year, but it all comes down to the same problem:

We all look for an efficient way to buy and sell our stocks

Some will use the buy & hold strategy and others will day trade or use technical analysis. Then, you will have others in the middle using ETFs indexing to implement a couch potato investing strategy. Within the crowd, you will also find growth investors, sometimes called traders and there are also value investors, a cousin not too far from the buy & hold people. Dividend Investing? Of course! That’s another type of investor focusing on revenues & yield.

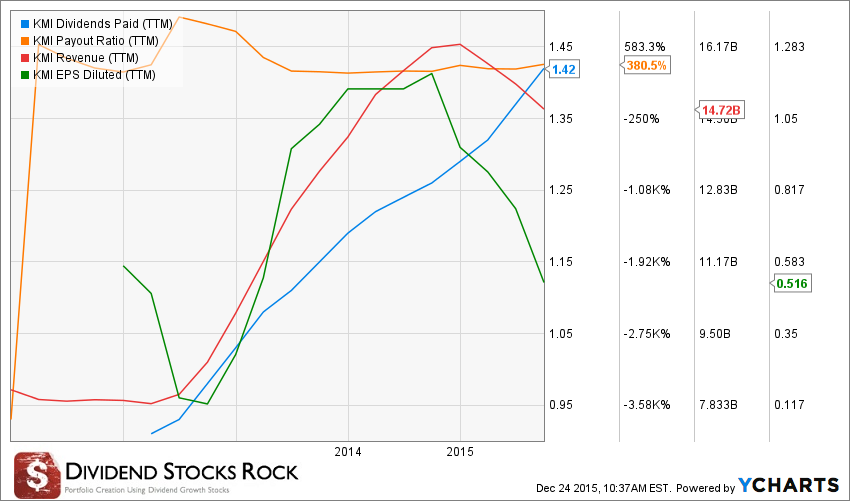

We all have our strategy and “magic recipe” to find sound and solid investments. But when we hit some headwind and volatility, the investing model is tested…. That is if we have one! I’ve been called many things such as “trader” or “fake dividend investor” because I’m not solely focusing on dividend yield and payment (remember that post?). However, the point I think I failed to highlight is that I focus on having a strong investing model instead of counting how much I make per month in dividend income. Funny enough, there are less Kinder Morgan (KMI) fans telling me they receive so much each month from their high yield dividend stocks now. The “Kinder Morgan Case” happened because many investors forget that buying a dividend stock doesn’t make you a dividend growth investor. Kinder Morgan cut their dividend payout by 75% in 2015 and several investors didn’t see that coming. However, it seems quite obvious to me that things weren’t going well for a while:

Stagnating revenues, erratic earnings and a ridiculously high payout ratio…. Death was announced a while ago, they just didn’t read the memo. How is that? Because they probably don’t have a solid investing model.

There are obviously limits to an investing model and we are all going to lose money once in a while with some of our investments. The idea is to win more often than you lose and never concentrate your investment so you don’t lose most of your money in a single losing trade.

Leave A Comment