One day after US equity markets closed the first trading day of the new year at an all time high for the first time since 1992, and the Nasdaq closed above 7,000 for the first time ever, US equities are set for further gains for equities on the second session of the new year after Tuesday’s sharp rally led by tech companies, as investors await minutes from the latest FOMC meeting. The dollar stabilized after five days of declines while Treasuries traded flat.

Overnight, world stocks hit fresh record highs on Wednesday with European markets joining the party as early 2018 is shaping up to be a carbon copy of late 2017. After its biggest one-day gain in more than two weeks on Tuesday, in the wake of its best year since 2009 in 2017, MSCI’s index of global stocks pushed on to new record highs.

“Investors have woken up in the new year and looked forward to another firm-year for global growth with very muted downside risk,” said Investec economist Philip Shaw, though he warned against reading too much into the first two trading days of the new year. “The converse is the sell-off in bond markets: the idea that inflation pressures may be firmer than expected and central banks could take a slightly more aggressive approach than previously thought.”

On Wednesday, Asian stocks pushed deeper into record territory driven by emerging markets as Japan markets remained closed. The MSCI index of Asia-Pacific shares outside Japan rose 0.4% having jumped 1.4% on Tuesday in its best performance since last March. Miners supported Australia’s ASX 200 (+0.2%), which comes amid Australia’s metals and mining index hovered at its best level in 5 years following the rise in metal prices with gold firmly above USD 1300, alongside the recent rally in zinc (zinc hit a 10-year high on Tuesday). Chinese markets initially conformed to the upbeat tone before Hong Kong shares ebbed lower (Shanghai Comp +0.6%, Hang Seng +0.1%), with focus also on the PBoC’s actions whereby they strengthened the CNY fix by the most since May 2016, where USDCNY fell below 6.50. Japanese markets remained closed and will reopen on Thursday. Emerging-market shares also gained for a second session.

Europe’s Stoxx 600 Index rose as much as 0.4%, the first advance in four days, as the euro weakened 0.3% against U.S. dollar to $1.2011. Retailers rally and technology companies follow overnight gains in U.S. peers while automakers rebounded from Tuesday’s slump and energy stocks also advanced, however trading volumes were about 25% lower than the 30-day average, in part as a result of the rollout of new MiFID II regulations.

Apple supplier AMS rose as much as 7.2% before paring gains, IQE gained 2%, while STMicroelectronics and Infineon both rally more than 1.5%; Apple rose 1.8% in U.S. trading yesterday. Silicon-wafer maker Siltronic advances as much as 4.6%; Credit Suisse wrote in a note that November preliminary monthly wafer data from Japan, which tracks ~50% of global wafer shipments, showed “solid” volumes and low inventories.

Next (+6.5%) leads a gauge of retail shares to the best industry performance as it raises its profit forecast after a better-than-expected Christmas. Tech shares climb the most in two weeks after Tuesday’s rally in the Nasdaq 100 Index.

Next is the first major listed retailer to give an update on Christmas trading, but its upbeat update also lifted peer Marks & Spencer by 1.4%. “As much as (Next‘s) update is good news, the constant update-by-update tinkering of guidance and sharp reactions by the share price just goes to show how shareholders are at the mercy of UK consumer trends and whims,” said Mike van Dulken, head of research at Accendo Markets. “The retail sector is a very tricky one.”

As a reminder, European investors are expected to trade cautiously today – and they are – as the biggest shake-up to market regulations in a decade begins. The MiFID II rules are one of the most seismic regulatory shifts in history, affecting everything from investment research to trade execution.

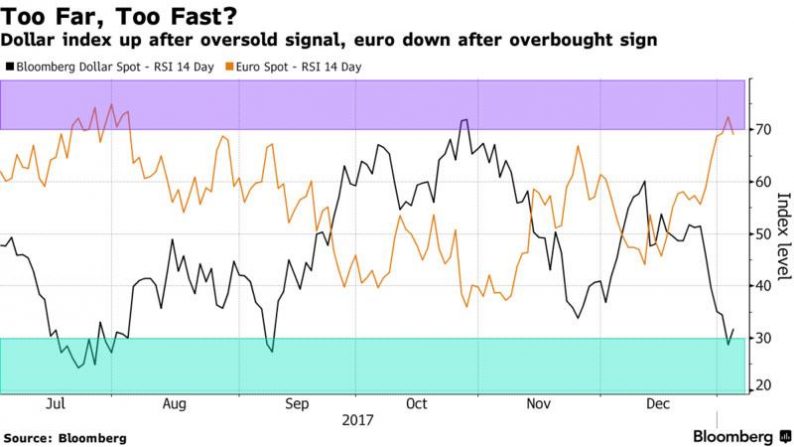

The oversold dollar halted a five-day decline against most G10 peers, helped by higher Treasury yields, ahead of today’s publication of the FOMC Dec. 12-13 policy meeting minutes. DXY pushes back above 92.00, providing a minor lift to USD against the G-10, albeit ranges are tight.

EMFX outperforms once again continuing trend from end of 2017, MSCI EMFX index approaching 2013 highs.

Overnight, the yield on 10-year Treasuries jumped by the most in two weeks on Tuesday, helping the dollar halt its slide. The euro and European bonds looked past continued hawkish signals from European Central Bank rate setters. European bonds rose even as Germany’s jobless rate dropped to a record low in December and the euro retreated for the first time in six days.

Leave A Comment