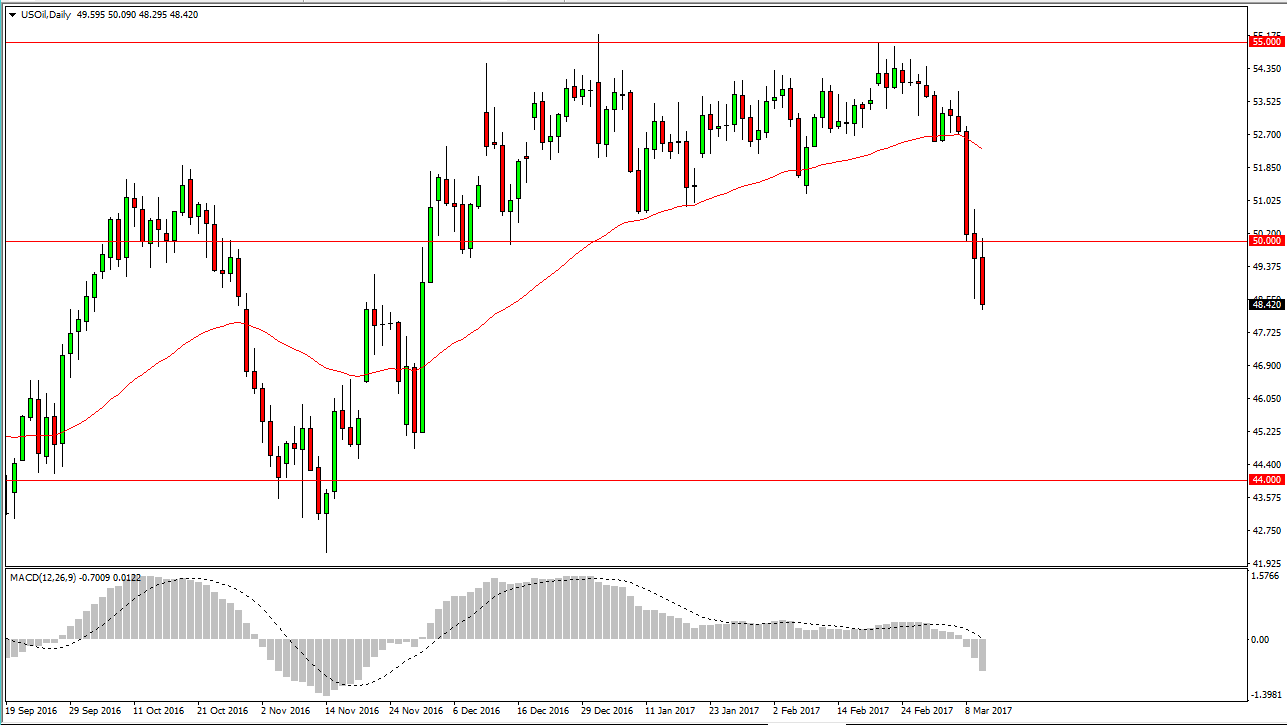

WTI Crude Oil

The WTI Crude Oil market rallied at the beginning of the Friday session, but found the $50 level to be too resistive. That’s not a huge surprise, as it is a large, round, psychologically significant number and of course have been supportive in the past. The fact that we fell late in the session and broke below the bottom of the range for Thursday shows that there is even more weakness in this market, and I believe that every time this market rallies short-term, it is a selling opportunity going forward. Ultimately, I think that the market should continue to reach towards the $45 level underneath as it has been support in the past.

Natural Gas

The natural gas markets rallied during the day, slicing through the $3 handle on Friday. We are currently testing the 100-day exponential moving average, and at the signs of exhaustion, I’m willing to start selling this market and of course on a breakdown below the bottom of the candle I’m willing to sell as well. I have no interest in buying natural gas, quite frankly the oversupply should continue and a lot of the moves over the last couple of days has been in reaction to the oil markets going lower. Typically, the markets tend to have a very negative correlation, and that seems to be the case.

If we do breakdown, I think will go down to the $2.75 level, and possibly even the $2.50 level. However, I don’t have the signal yet but we are certainly at an area where I would expect to see it. Ultimately, I have no interest in buying natural gas, and believe that sooner or later warmer temperatures, oversupply, and quite frankly lack of demand will drive the value of the natural gas markets much lower.

Leave A Comment