The Japanese yen remains firmly in focus this morning as fears of contagion concerning the Turkish lira continue to dominate the markets, with significant gapped down opens for all the yen pairs across the complex. As a barometer of risk, the AUD/JPY is just one example as trading gets underway in London with the pair opening well below Friday night’s close.

The yen index below reflects the inverse, with the strong yen buying of last week clearly signaled on the daily chart with the two widespread up candles, and a gap up here mirroring what we are seeing across all the major yen pairs as the index breaks through the 8400. As always, we need to signal a note of caution as gaps are often filled, particularly when triggered by such news events with sentiment then reversing just as quickly as the sun shines once more.

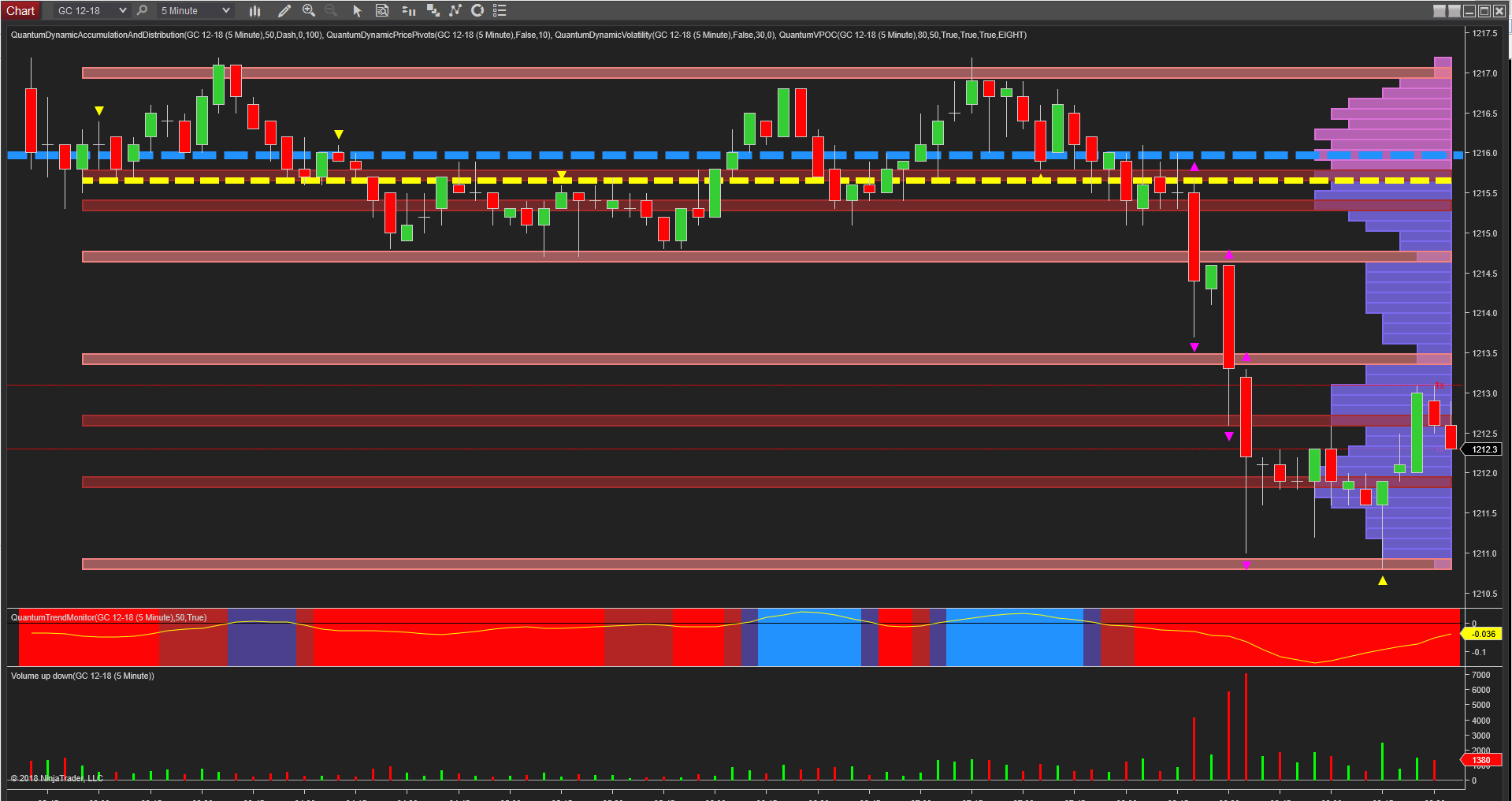

It is also interesting to note that gold is falling on Globex on the 5m chart(as well as remaining very bearish longer term), along with these pairs, and suggesting safe haven flows are moving to other assets, and not to the precious metal.

Finally, as we would expect in such a rout the major US and European indices are trading lower, with the NQ emni down over 30 points in early trading.

Leave A Comment