Photo Credit:Sarah Marshall

As the door closes on another earnings season, investors can relax for a few weeks until the next one begins. Fourth quarter earnings were largely disappointing with far and few names able to make a splash. However, it hasn’t been so bad for everyone and ahead of Q1 earnings a number of companies are poised to impress investors. They include, Lending Tree (TREE), Facebook (FB), Hasbro (HAS), Intuitive Surgical (ISRG) and Priceline (PCLN). According to the Estimize data these names have been on the move, as witnessed by consistent year over year growth, heavy upward revisions and a history of beating expectations.The combination of these factors have typically led to subtantial outperformances.

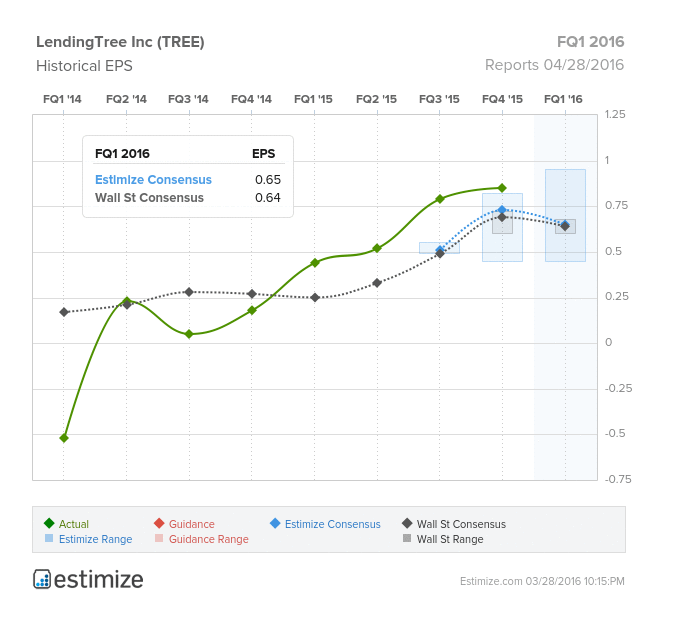

Lending Tree (TREE) Financials – Thrifts & Mortgage Finance

One of the early adopters in the recent wave of financial technology, Lending Tree has successfully expanded to the point where it has now been trading on the market for 7 years. In this time shares have skyrocketed from their $10 IPO in 2009 to $94, where they are today. Lending Tree has been on a spree of strong earnings, beating on the bottom line in each of the past 4 quarters. Revenue has been just as good if not better, trumping expectations in 5 consecutive quarter. The Feds move to raise interest rates at the start of the year, gave the lending company a nice boost heading into its fiscal 2016. The Estimize community has been bullish on Lending Tree, increasing EPS estimates 7% and revenue 14% in the past month. As a result, the data is calling for EPS of $0.67, 2% higher than Wall Street and revenue of $85.60 million, right in line with the Street. Compared to the year prior, this predicts as a YoY increase in earnings of 53% while sales are looking to grow 68%. Lending Tree consistently beats Estimize and Wall Street, trumping on the top line 50% and 90% of reported quarter, respectively.

Facebook (FB) Information Technology – Internet Software & Services

Leave A Comment