AT40 = 44.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 48.9% of stocks are trading above their respective 200DMAs

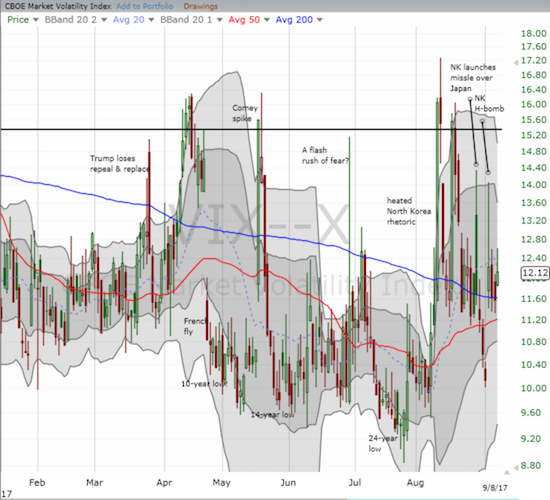

VIX = 12.1 (up 4.9%)

Short-term Trading Call: neutral

Commentary

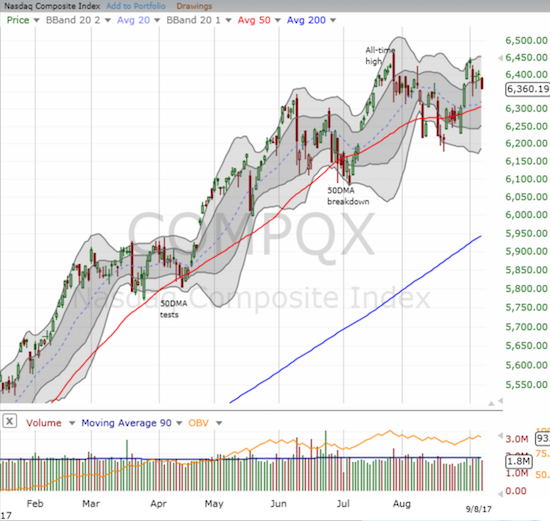

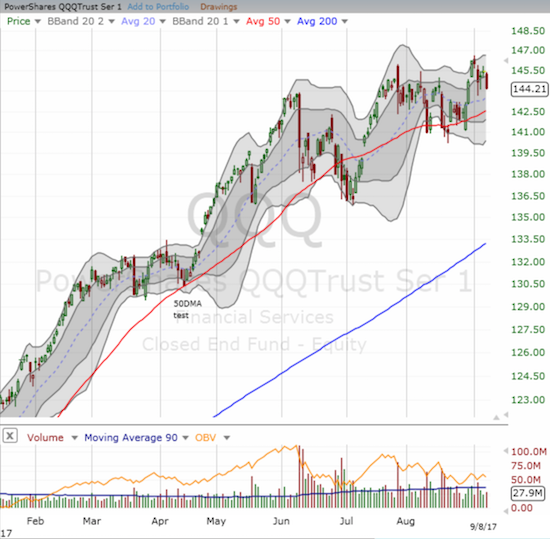

The market has made no progress since my last Above the 40 post which covered the volatility and fizzle from Tuesday, September 5th. Tensions remain given the volatility index, the VIX, closed the week with a gain on the day and remains well above last Friday’s extreme low of 10.1. The S&P 500 (SPY) lost fractionally and closed down for the week for what is three weekly losses over the last 5 weeks. The NASDAQ is actually down 5 of the last 7 weeks. The same for the PowerShares QQQ Trust (QQQ). If not for the large rally last week, these indices would look bearish.

The S&P 500 managed to close the week still hovering above its 50DMA support.

The Nasdaq closed at its low for the week but remains well above its 50DMA support line.

The PowerShares QQQ Trust also closed at its low for the week well above its 50DMA support.

The volatility index is suddenly looking like it wants to hold its ground between 11.50 and 12.50. Watch out for this area of congestion serving as a springboard for the next volatility spike.

AT40 (T2108), the percentage of stocks trading above their 40-day moving averages (DMAs), managed to avoid closing at its low for the week…just barely. Like the indices, it held onto much of its gains from the previous week’s rally. As a result, there is still no reason to get (short-term) bearish even as the reasons for bullishness are similarly weak. The market is in a stalemate awaiting the next catalyst. With the debt ceiling fight kicked down the road for another day, a key tell will be the market’s reaction to the next North Korean missile/nuke test. The time may already have arrived where the market will generally ignore these actions, and even the words out of Washington in response. Only action from the U.S. may stir the pot all over again in financial markets.

Leave A Comment