Apple’s (AAPL – Analyst Report) better than expected earnings report follows strong readings from other Tech sector bellwethers like Google’s parent Alphabet (GOOGL – Analyst Report), Microsoft (MSFT – Analyst Report) and Amazon (AMZN – Analyst Report). Amazon is basically a retailer, but it’s ability to turn that space upside down has been a function of its Tech prowess that has forced others like Wal-Mart (WMT – Analyst Report) and Best Buy (BBY – Analyst Report) to reposition their respective businesses.

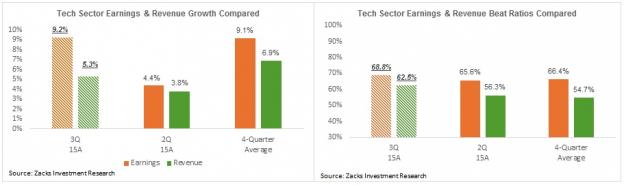

The Tech sector has stood out in this otherwise weak Q3 earnings season from most other sectors. Including this evening’s Apple report, we now have Q3 reports from 32 of the 64 Tech companies in the S&P 500 that combined account for 65.6% of the sector’s total market cap in the index. Total earnings for these 32 Tech companies are up +9.2% from the same period last year on +5.3% higher revenues, with 68.8% beating EPS estimates and 62.5% beating revenue estimates. This is a better performance than we have seen from this same group of 32 Tech companies in other recent periods, as the comparison charts below show.

The S&P 500 Scorecard (as of October 27th, 2015)

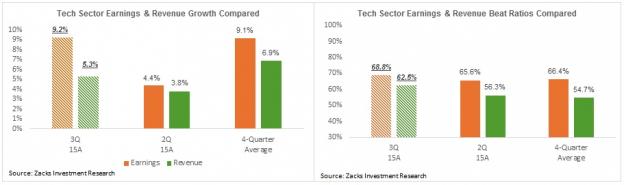

Including this afternoon’s results from the likes of Apple, Gilead (GILD) and others, we now have Q3 results from 227 S&P 500 members that combined account for 56.6% of the index’s total market capitalization. Total earnings for these 227 companies are up +3.8% from the period last year, with 70.6% beating earnings estimates. Total revenues for these companies are down -0.9% from the same period last year, with only 42.1% beating top-line estimates.

Here is the current scorecard for the 227 S&P 500 companies that have reported results already.

This is weak performance compared to what we have seen from the same group of companies in other recent quarters, particularly on the revenue side, as the charts below shows.

Leave A Comment