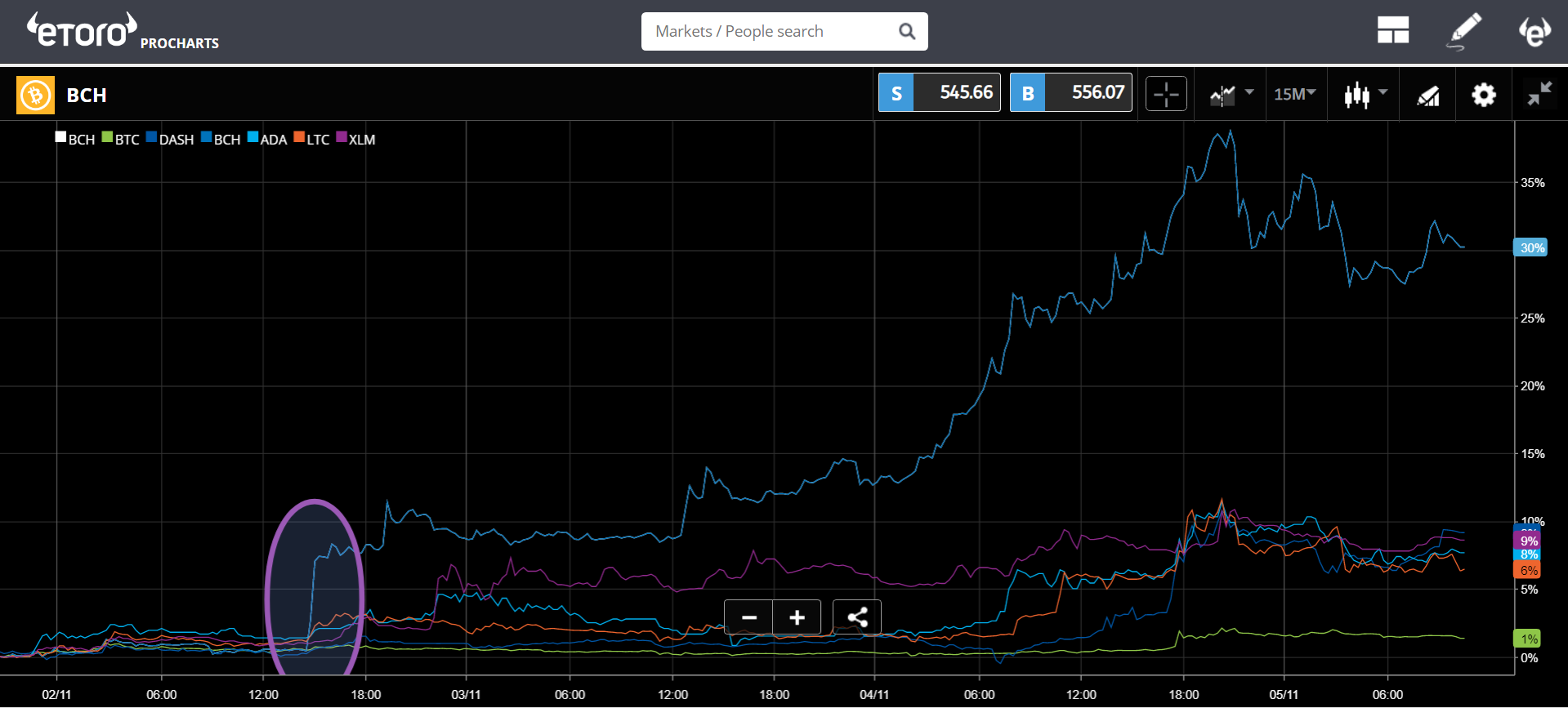

A broad rally has emerged over the weekend across the Crypto markets. Be cautious of this one though.

The sudden excitement started with Bitcoin Cash, which made a leap on Friday after several major crypto exchanges announced they will support an upcoming hard fork that will take place on November 15th.

Bitcoin Cash has surged well into the weekend but does seem to be pulling back a bit this morning.

The thing is, it’s not entirely clear how this hard fork is going to play out. Several of the largest Bitcoin Cash supporters are apparently locked in a Mexican Standoff, each with their own views of how Satoshi’s vision should be implemented.

Prices are moving up now because the perception is that BCH holders might get an additional coin (or two) for their bravery in the event of a chain split. However, it’s just as likely at this point that if things go sour the new coins could be worthless.

Today’s Highlights

Traditional Markets

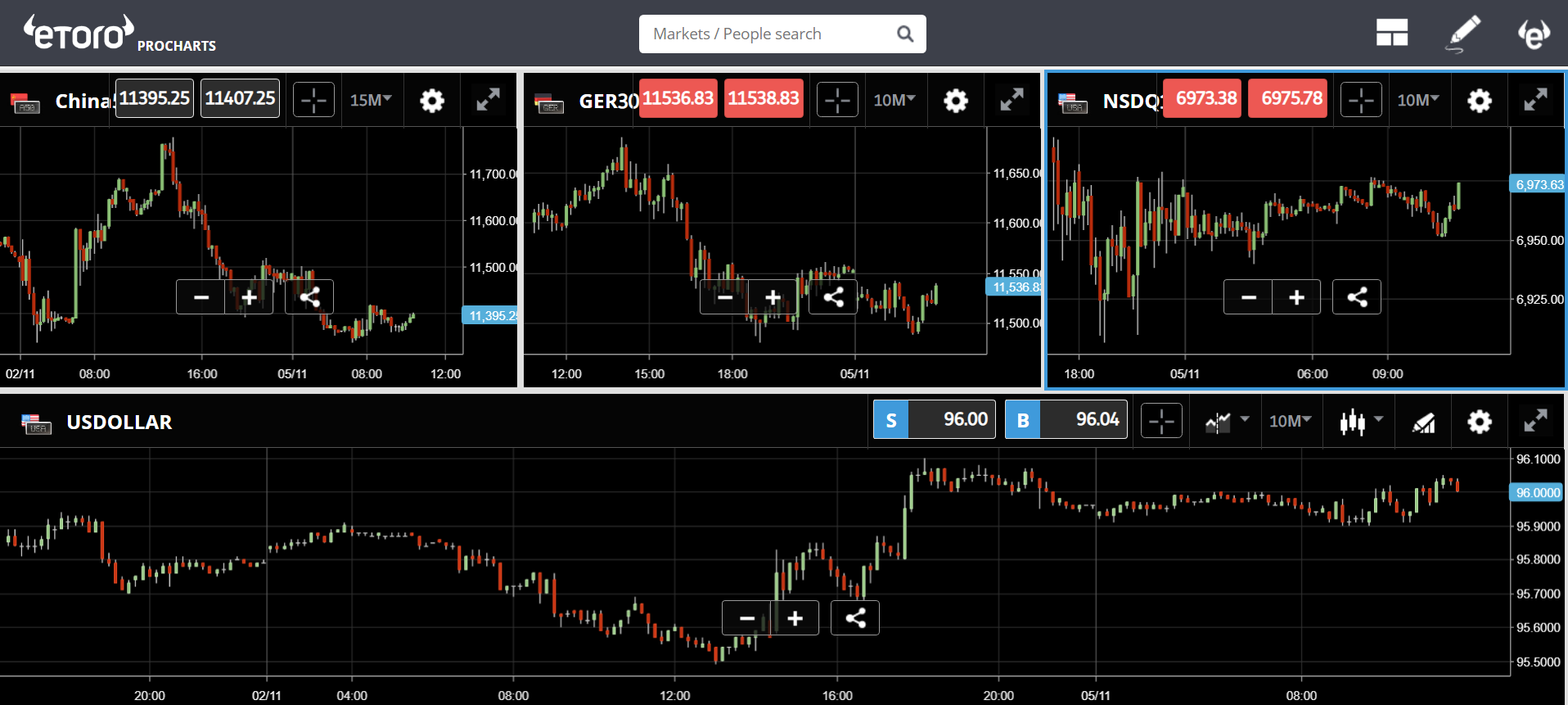

Markets are mixed this morning. Stocks in Asia are mostly down but the European markets have managed to stay slightly positive so far. This comes as the US Dollar continues to venture higher this week.

Focus in the United States is currently on the mid-term elections tomorrow. From the looks of it the odds of any change in leadership are fairly narrow at this point. The perception is that the Republicans might even increase their foothold in the Senate rather than lose it

What investors are even more concerned with for now is what the Fed will have to say during their interest rate meeting on Thursday. Will Jerome Powell move to a more dovish stance in order to support prices in the wake of Red October or will they continue with their current rate increase trajectory?

The answer will likely have a effect on the markets.

Leave A Comment