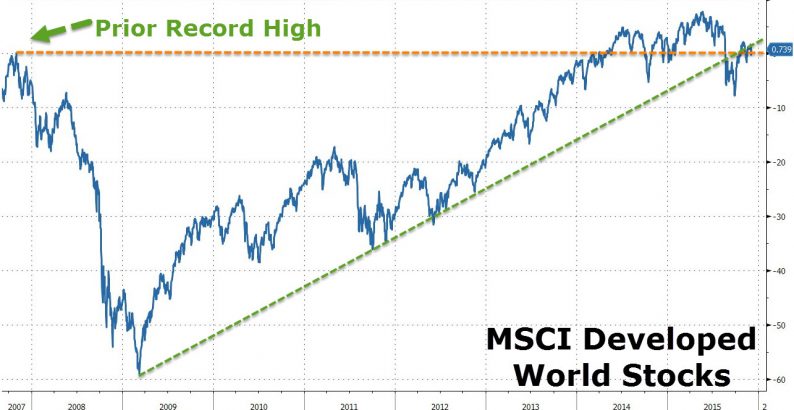

Global equity markets, as measured by the MSCI Developed World index, are above the lows hit in early October but remain on a downtrend that began after markets peaked at the end of May this year.

As SocGen’s Andrew Lapthorne notes, the current level is now only just above where the index stood at the beginning of 2013 and less than 1% above the 2007 peak. In other words, as he warns, “the equity market has run out of momentum,” and the ‘bill’ for the debt overhang is coming due.

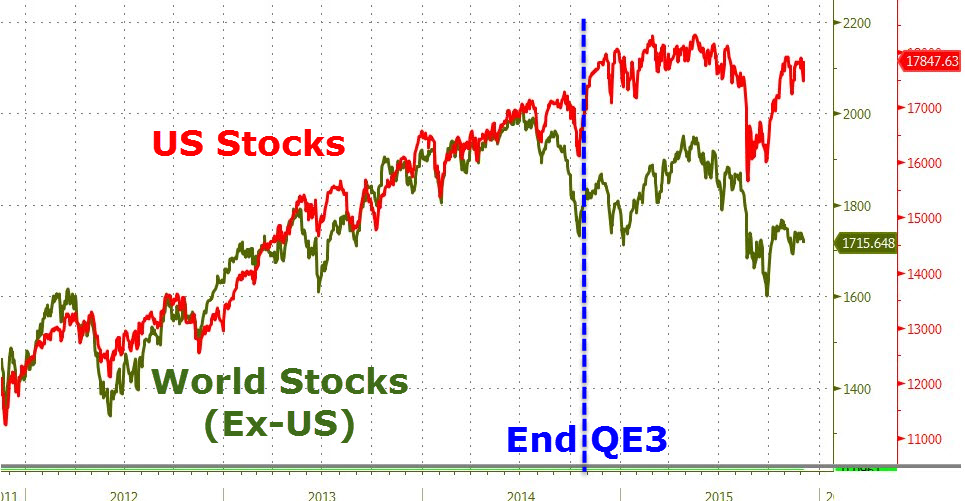

The recovery since 2007 has been very one-sided with only Denmark, Switzerland and the US indices exceeding their October 2007 US dollar price levels.

The UK is down 34% in US dollar terms and the MSCI Eurozone is 40% down. The reasons for this weak performance is fairly clear, unlike Japan neither the UK or Eurozone have experienced an earnings recovery in either US dollar terms or in local currency terms. Profits in both regions are still 45-55% down from the 2007 high according to MSCI reported profits.

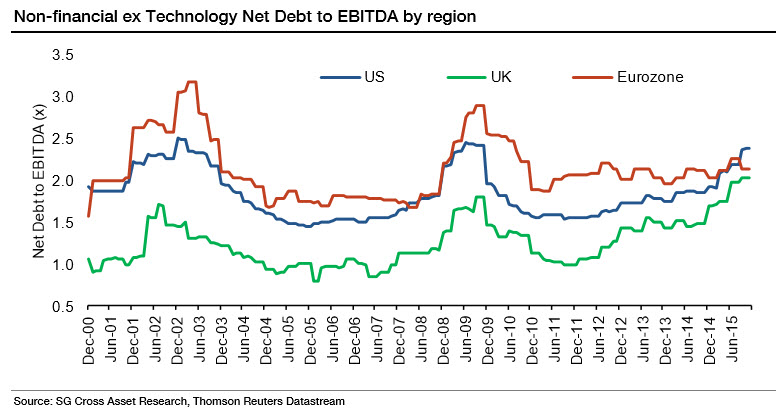

The Eurozone of course has many problems, but at least Eurozone companies have not been boosting leverage as a consequence of disappointing profits, as is the case in the US and apparently the UK as well! As we have remarked upon on numerous occasions, the US equity market has been boosting leverage with record levels of debt-financed share buybacks, resulting in a significant increase in leverage among US corporates.

However with all the focus on the US, many investors may have missed the major corporate debt problem now emerging in the UK stock market. Devoid of the headline-grabbing buybacks, many may not have noticed that both nominal net debt and net debt to EBITDA have never been higher in the UK.

The bulk of that increase has come from a huge rise in Mining sector debt at a time when profits have collapsed, but leverage ratios in other sectors are also elevated. The US is not the only market now facing a corporate debt overhang.

Leave A Comment