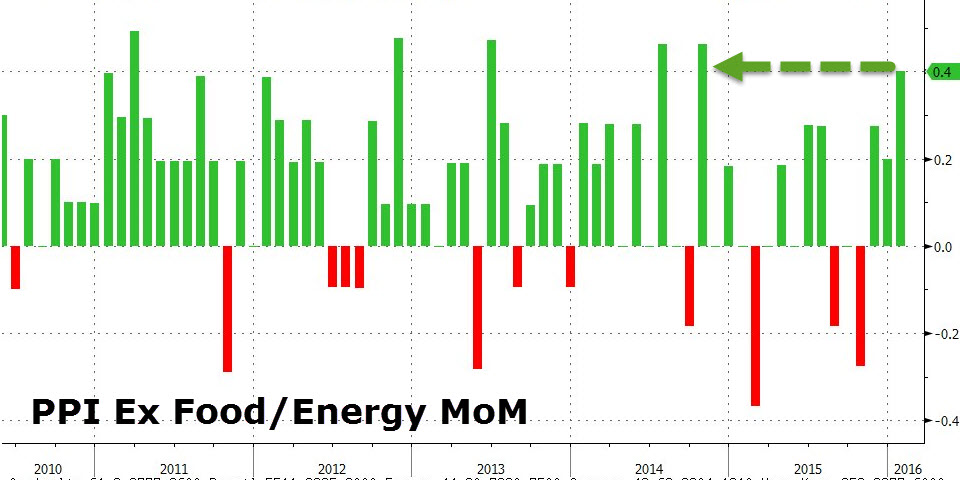

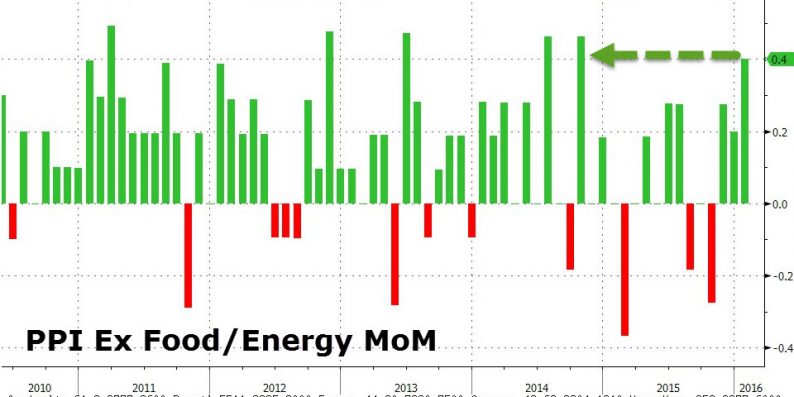

Producer Prices (ex food and energy) jumped 0.4% MoM – the biggest rise since Oct 2014 (and dramatically hotter than the 0.1% rise expected). Rubbing salt into Fed mandate wounds still further is last month’s print was also revised higher and YoY (+0.6%) is the highest since Sep 2015. Across the range of PPI data, all items came hotter than expected in January (despite a 5% drop in Energy) with Food rising most in 20 months.

Inflation hotting up…

As Bloomberg notes, wholesale prices in the U.S. unexpectedly increased in January as higher food costs more than made up for the plunge in energy.

Food prices increased 1 percent last month after a 1.4 percent drop. Energy expenses declined 5 percent in January after a 3.5 percent drop the month before.

Wholesale prices excluding these two components climbed 0.4 percent in January from the month before, compared with the 0.1 percent increase seen by the median forecast of economists surveyed. It followed a 0.2 percent increase in December. Those costs were up 0.6 percent from January 2015.

Also eliminating trade services to arrive at a reading some economists prefer because it excludes one of the report’s most volatile components, wholesale costs rose 0.2 percent in January from a month earlier, the same as in December.

With Food prices up most since April 2014…

So, inflation is starting to hot up and the jobs data is ‘awesome’ – what is The “data dependent” Fed to do next?

Leave A Comment