Much will be decided tomorrow. Metals and Miners could break either way. Prices will respond to interest rate expectations. Gold will remain under pressure as long as interest rates continue on a steady path higher. Gold should rally if the Fed appears dovish.

I’ll post multiple updates throughout the day.

US Dollar – The ABC structure could be complete, we will find out later this week. Breaking below the 200-day MA would imply a more profound correction.

GOLD 4-HOUR CHART: Prices have been consolidating for a month. They will either break higher or lower this week. For an upside breakout, prices need to defeat the $1215 – $1218 zone. Whereas, declining below $1196 and $1192 would support a failed cycle and recommend a test and potential breakdown below $1167.

Gold – Prices are coiled, and we will likely see a sharp move in either direction.

Silver – Prices closed above the 20-day EMA for the first time in 3-months. Closing sharply above $14.60 would support an upside breakout. Whereas, closing below $14.25 could prompt another sharp breakdown.

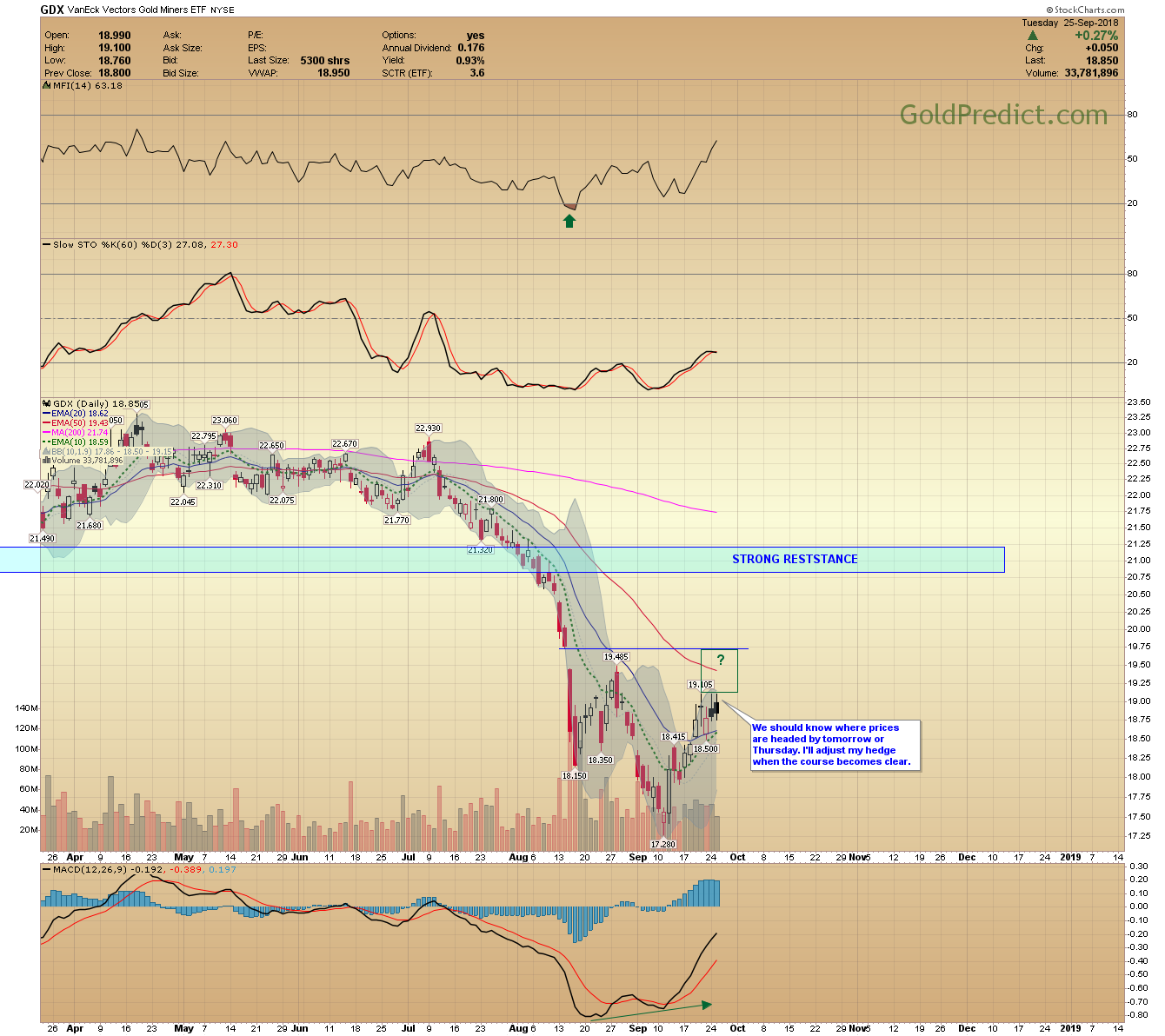

GDX – We should know where prices are headed by tomorrow or Thursday. I’ll adjust my hedge when the course becomes clear.

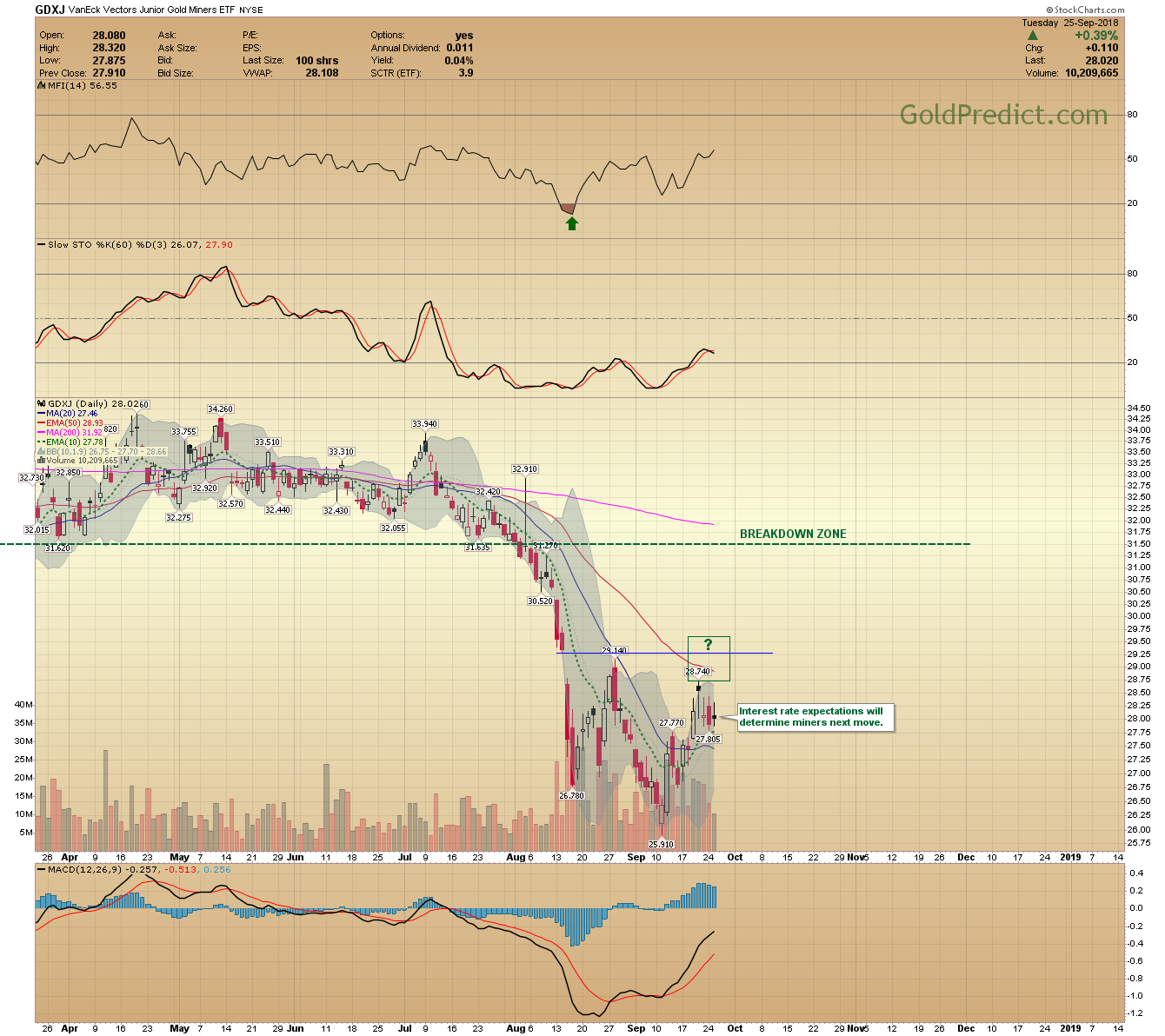

GDXJ – Interest rate expectations will determine miners next move.

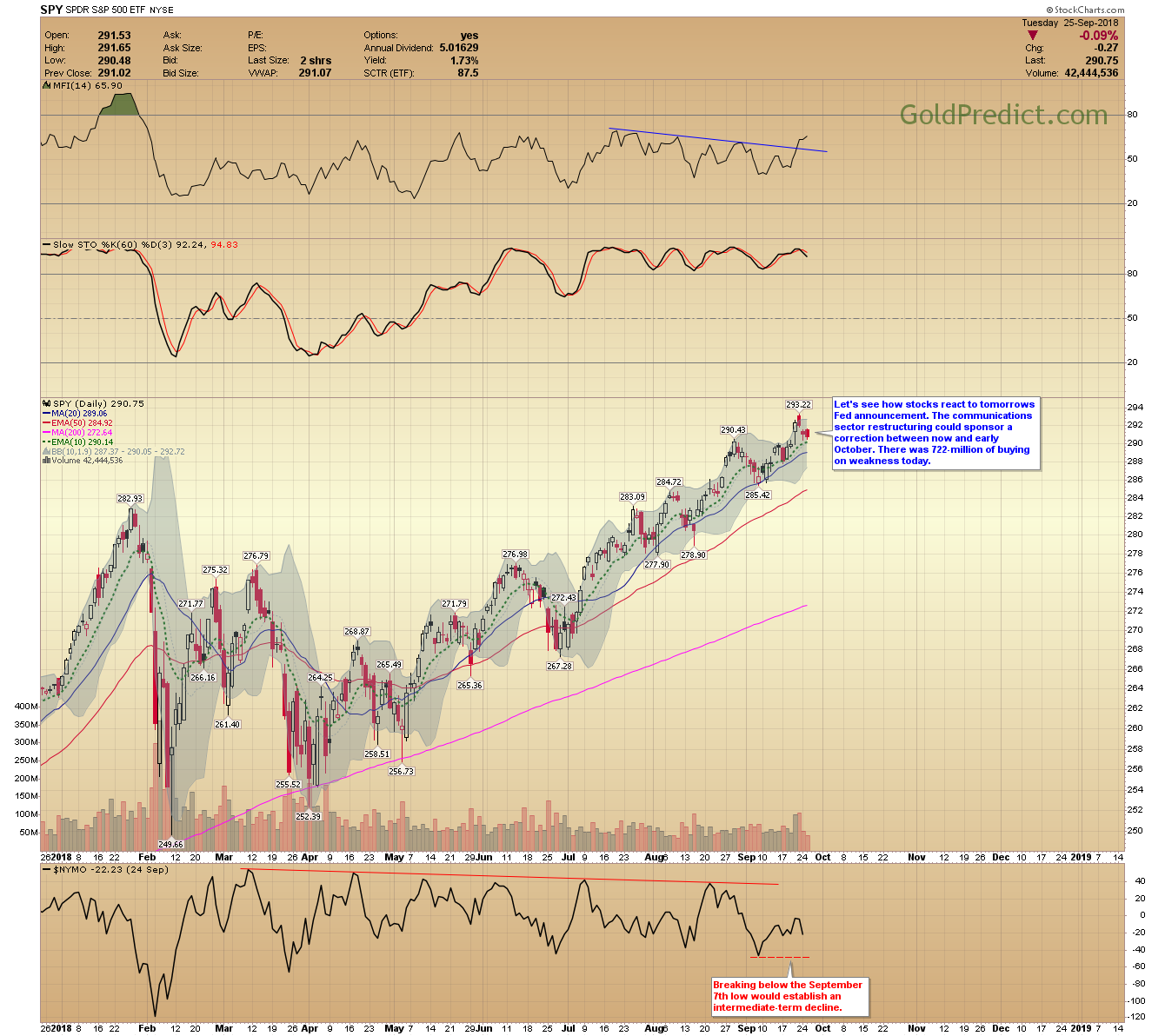

SPY – Let’s see how stocks react to tomorrows Fed announcement. The communications sector restructuring could sponsor a correction between now and early October. There was 722-million in buying on weakness today.

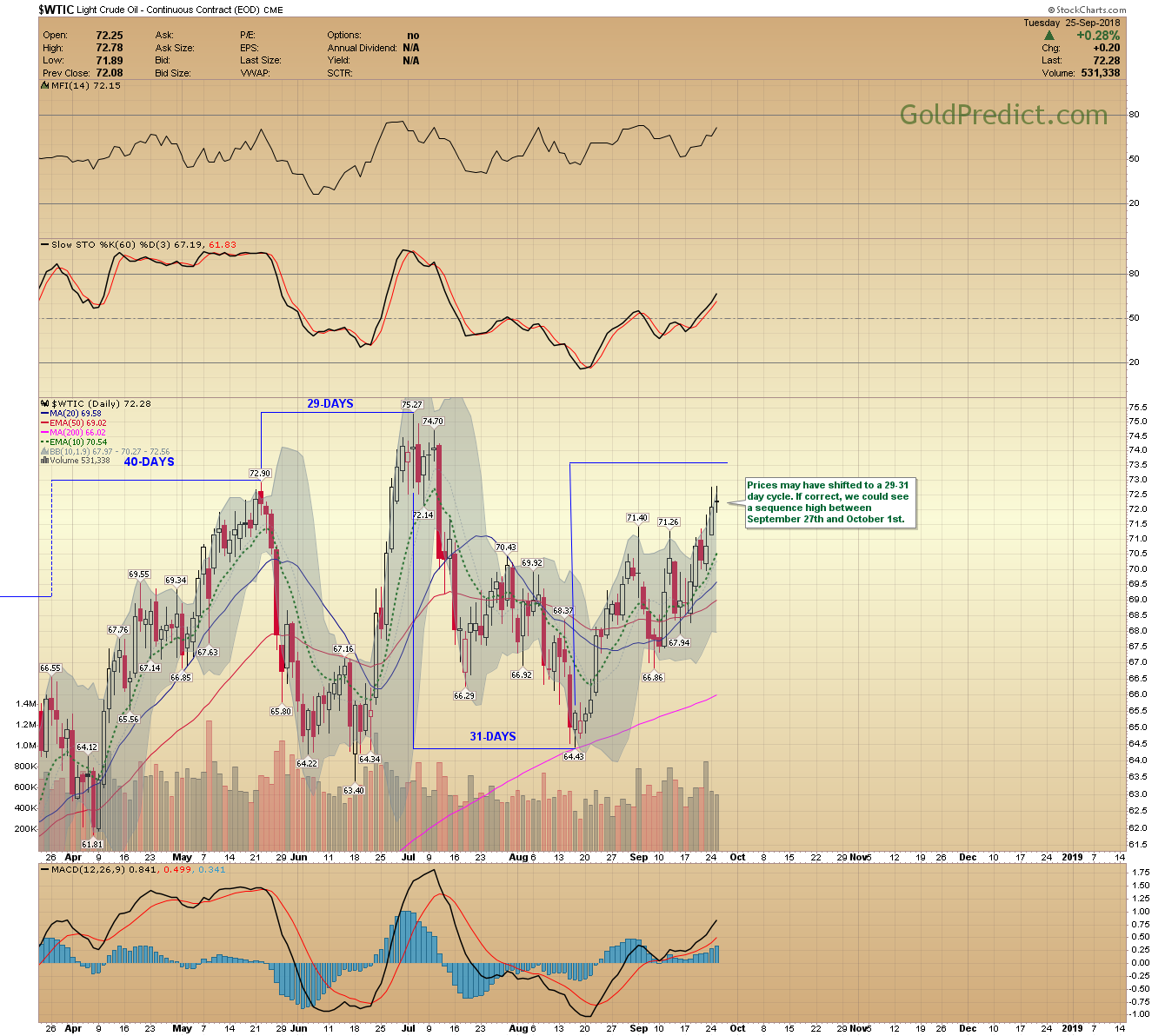

WTIC – Prices may have shifted to a 29-31 day cycle. If correct, we could see a sequence high between September 27th and October 1st.

Leave A Comment