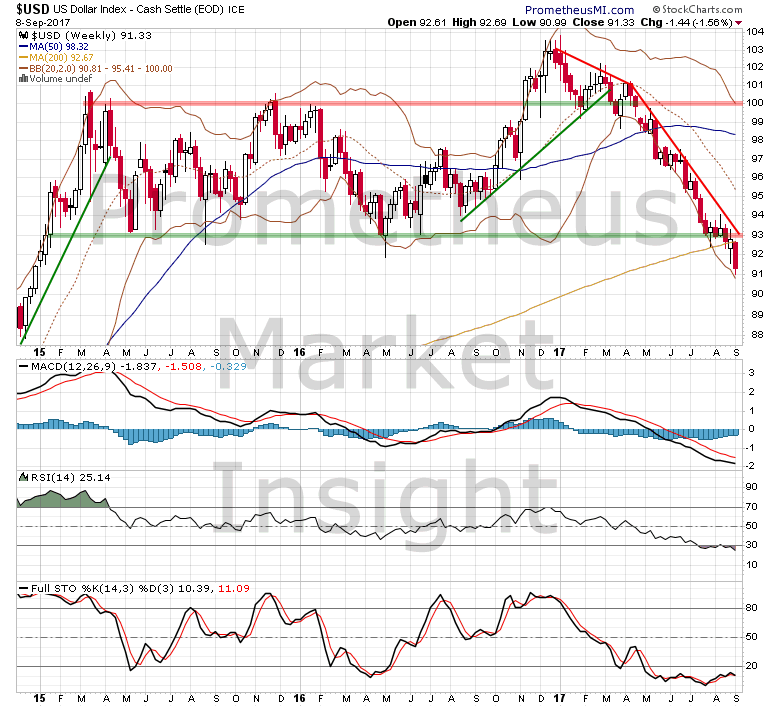

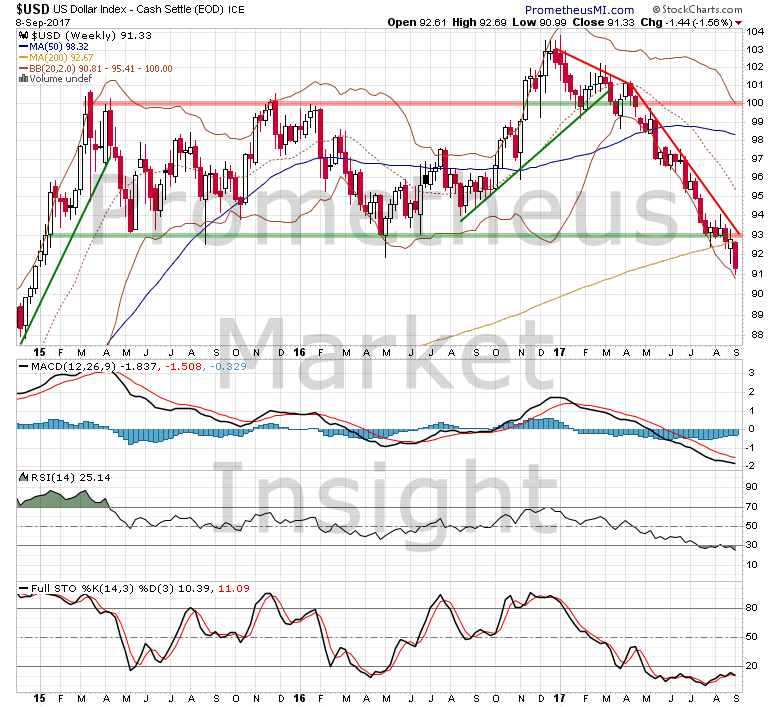

In early August, we observed that the US Dollar index was on the verge of a meaningful breakdown. Our technical analysis suggested that a weekly close below the congestion support level in the 93 area would likely be followed by a resumption of the downtrend from early 2017. This week, the index moved sharply lower, confirming the recent intermediate-term breakdown and forecasting substantial additional losses moving forward.

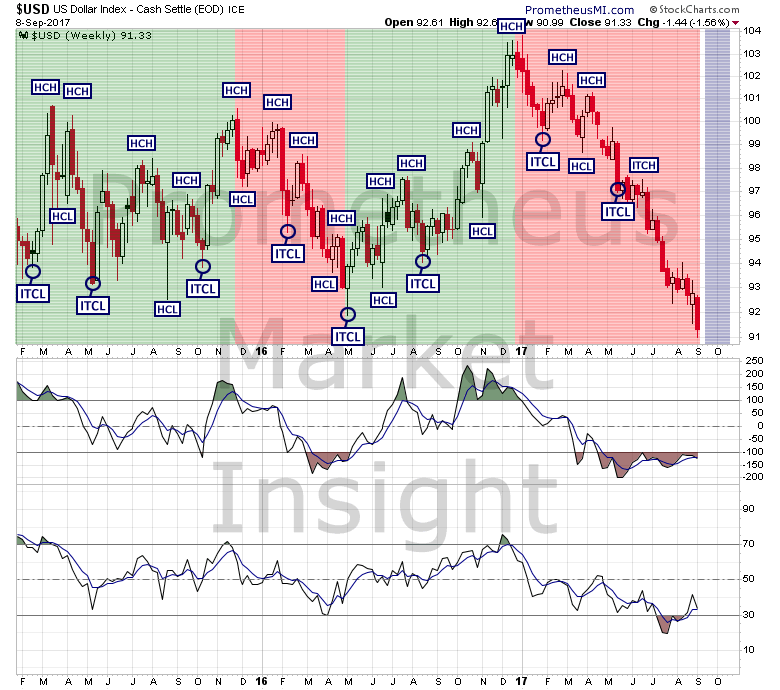

The sharp decline during the last 3 weeks has caused a slight change to our preferred cycle analysis model, indicating that the last intermediate-term cycle low (ITCL) likely formed in May. The character of the current cycle remains extremely bearish, favoring additional losses heading into the next ITCL that will likely form sometime in late September of early October.

The recent intermediate-term breakdown of the US Dollar index was a meaningful development, and our computer models indicate that additional losses are likely during the next 2 to 6 weeks.

Leave A Comment