I’m not sure how much markets are going to care about the Fed minutes given how much hawkish rhetoric we’ve gotten since the June hike and given the fact that it is now abundantly clear that the committee is pursuing a bubble-busting “third mandate” aimed at curbing risk taking by leaning against loose financial conditions (lackluster inflation be damned), but I suppose if you parse them to death, you can find something to trade on.

Below, you can find a list of 4 things Citi is looking for – basically it’s the same list anyone who hasn’t been asleep for six months is looking at…

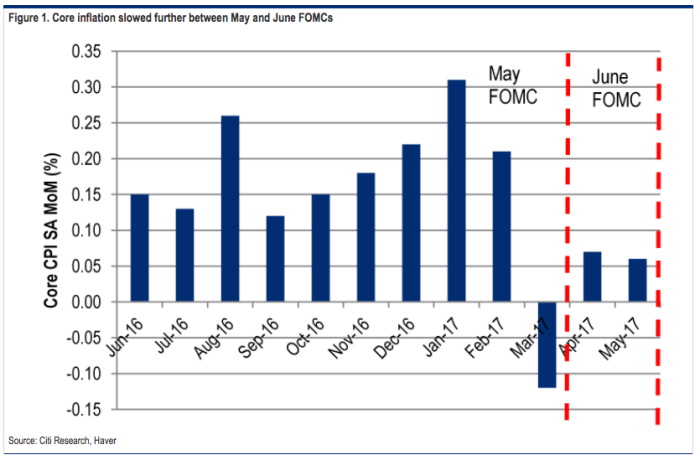

Minutes from the June meeting are unlikely to hold a hawkish surprise relative to confidence Fed officials have expressed in hiking despite slowing inflation.

We will look to the minutes for the FOMC’s answers to four question:

- How much must inflation accelerate to keep the Fed hiking?

- Do tight labor markets create near-term pressure to hike?

- Are easy financial conditions a rising concern?

- When will balance sheet reduction be announced and will the announcement imply a “pause” in rate hikes?

That bolded question is probably the most important as the answer to it holds the key to answering the other questions.

In any event, here are the highlights from the just released minutes for you to take to your local palm reader…

Via Bloomberg

Leave A Comment