There are a series of European economic indicators reporting this month (and in early May) that will directly reflect the economic sentiment around the Brexit process and the upcoming political elections in Germany and France. Analysts at Estimize have reached consensus on the following indicators: Euro Area Business Confidence, Consumer Confidence, Balance of Trade, and Unemployment Rate.

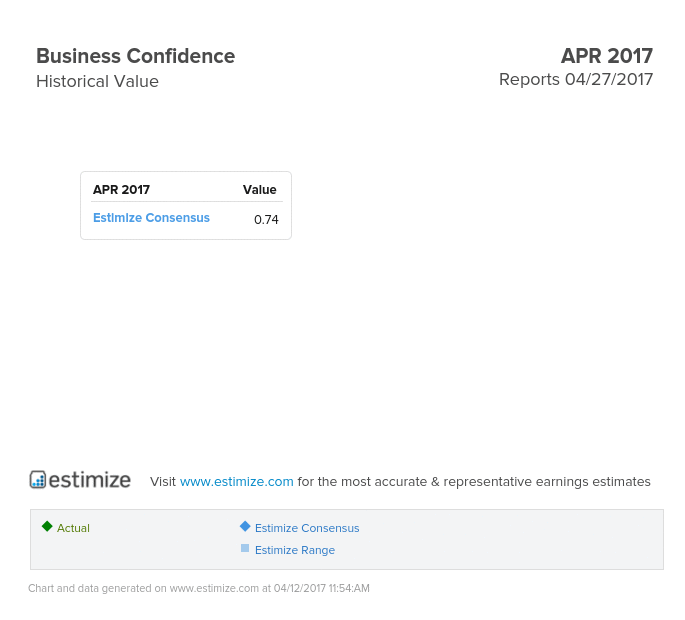

Euro Area Business Confidence (Reports on April 27th): As the official Brexit papers have been filed, Britain will transition into an independent economy in the next 8-10 months. Many businesses that are based in the UK have contingency plans that will move their operations out of Europe. With the loss of Britain’s numerous resources and opportunities, businesses in Europe will most likely be pessimistic over time. In March, the business climate indicator stood at 0.82 compared with the Estimize consensus of 0.84. For April, the Estimize community forecasts a decline to 0.74 from 0.82. According to the Wall Street Journal, many economists had expected sentiment to weaken this year, given the high levels of uncertainty created by upcoming elections in which potential political candidates are hostile to the Euro.

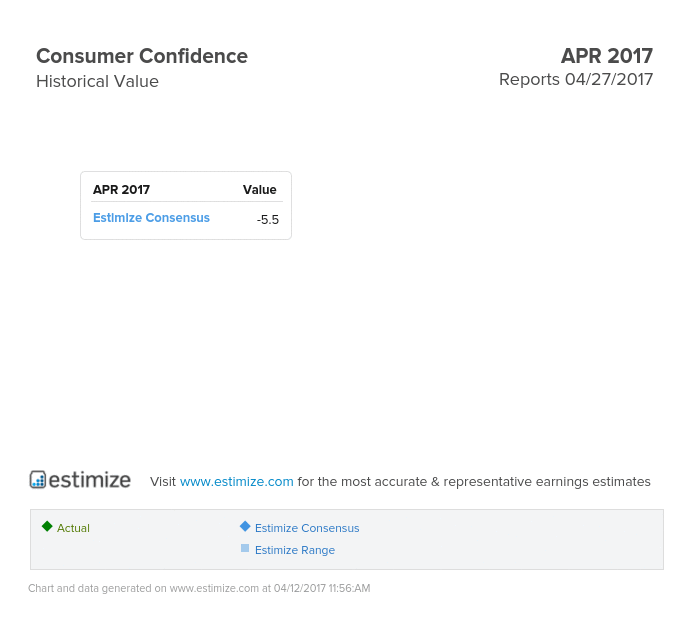

Euro Area Consumer Confidence (Reports on April 27th): Consumer confidence in the Euro Area increased to -5.0 in March from -6.2 in February of 2017. Consumer confidence in the Euro Area averaged -12.21 from 1985 until 2017, reaching an all time high of 2.3 in May of 2000 and a record low of -34.5 in March of 2009. For April, analysts at Estimize forecast a decrease of 0.5 from March to -5.5. Consumers face a similar concern as that of businesses. Due to Britain’s economic separation, consumers in Europe will face a rise in prices for non-durable and durable goods, thus generating less optimism in consumption.

Euro Area Balance of Trade (Reports on April 19th): The Euro Area Trade Balance shifted to a 0.6 billion deficit in January 2017 from 4.8 billion surplus in the same month of the previous year. It was the first trade gap since January 2014 and the biggest since January 2013. For February, Estimize analysts forecast a significant surplus of 12.9 billion from the 0.6 deficit last month. Due to the unsettling trade policies from Britain, Europe will most likely face temporary volatile trade balances for next 6-8 months.

Leave A Comment