“The dollar rally is far from over,” Goldman’s Robin Brooks said, just hours before this week’s FOMC announcement.

“We expect the Fed to signal that it wants to continue normalizing policy, which means three hikes this year and four in 2017,” Brooks continued. “Overall, our sense is that the outcome will be more hawkish than market pricing.”

Yes, “a hawkish outcome” was on the way, which should have led directly to a DM monetary policy divergence the size and scope of which would be unprecedented in the post-crisis era.

Our warning to the market: “Given the fact that i) Brooks’ calls are generally about as accurate as Gartman’s, and ii) Goldman is one for six so far on its Top Trades for 2016, you might want to go with the market’s view on this one to avoid getting the muppet treatment.”

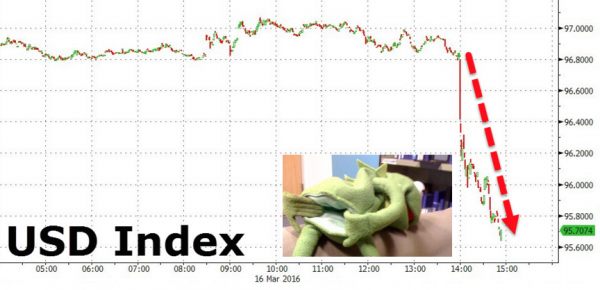

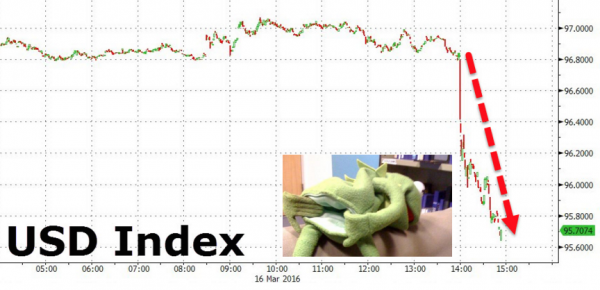

A few hours later, citing growing risks to global financial markets, the FOMC delivered an exceptionally dovish decision, as the median forecast for 2016 rate hikes dropped to just 2 from 4 previously. Here’s what happened next:

Apparently, the Fed’s dovish lean was part of a coordinated effort on the part of global central banks. Have a look at our annotated chart:

Anyway, Goldman is apparently convinced that it’s not so much the bank’s forecast that was wrong, but rather the FOMC is simply mistaken in its projections about what it will itself eventually do.

As the bank’s chief economist Jan Hatzius explains, Goldman is “more confident than the FOMC that both wage and core price inflation have started to move higher,” and “therefore, [Goldman] continues to expect three Fed hikes this year,” not two.

Generally speaking, Goldman isn’t buying the whole global coordinated easing argument. Well, that’s not entirely accurate. Hatzius agrees that’s what’s been going on this month, but doesn’t think the Fed will be willing to play along for that much longer. Here’s Goldman on central banks’ collective effort to keep the spigots open and avoid the type of USD strength that suppresses commodities and adds to the deflationary impulse:

Leave A Comment