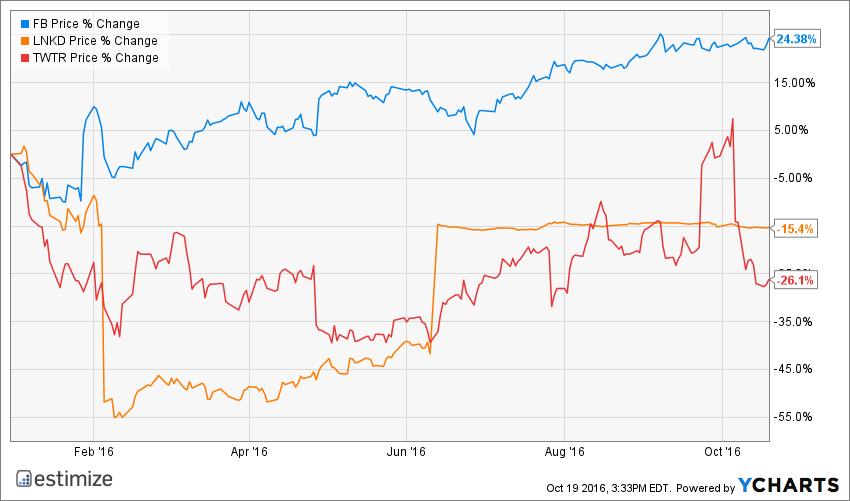

Whether it’s Facebook, Twitter, or LinkedIn, social media has become an integral part of our day-to-day lives. These companies have been successful on the premise that we must know what each other is doing at a moment’s notice. Now that they are all publicly traded companies, lofty expectations have been placed on them to grow their user base, increase revenue, and expand out of social media, all at the same time.

Photo Credit: Andreas Eldh

Facebook has largely lived up to the expectations, Linkedin was steadily improving until its takeover by Microsoft, and Twitter is still struggling to find its identity.

Facebook (FB) Information Technology – Internet Software & Services

Facebook is still one of the most impressive names in this space despite hitting some speed bumps recently. The social media company continues to top earnings and revenue expectations driven by strength in its mobile platform and strategic acquisitions. The upcoming quarter will be the first to feature sales figures from the highly anticipated Oculus Rift. Virtual reality is expected to be one of the fastest growing sectors, providing a new source of revenue moving forward. This should help offset the blow Facebook is about to take after years of over-inflating its video metrics. This type of deception will certainly have a short-term impact on advertising revenue. Additionally, SnapChat is on pace to become a legitimate threat to Facebook’s core business, sooner rather than later. The Evan Spiegel run company currently boasts 60 million daily users in the U.S. and Canada, about a third of what Facebook has in these markets. Lofty expectations have still been placed on Facebook to blow out its third quarter report. The Estimize consensus is calling for earnings per share of $1.02 on $7.01 billion in revenue. Compared to a year earlier that represents a 75% increase on the bottom line and 54% on the top.

LinkedIn (LNKD) Information Technology – Internet Software & Services

Leave A Comment