How is this a GDP that’s growing by 7% a year?

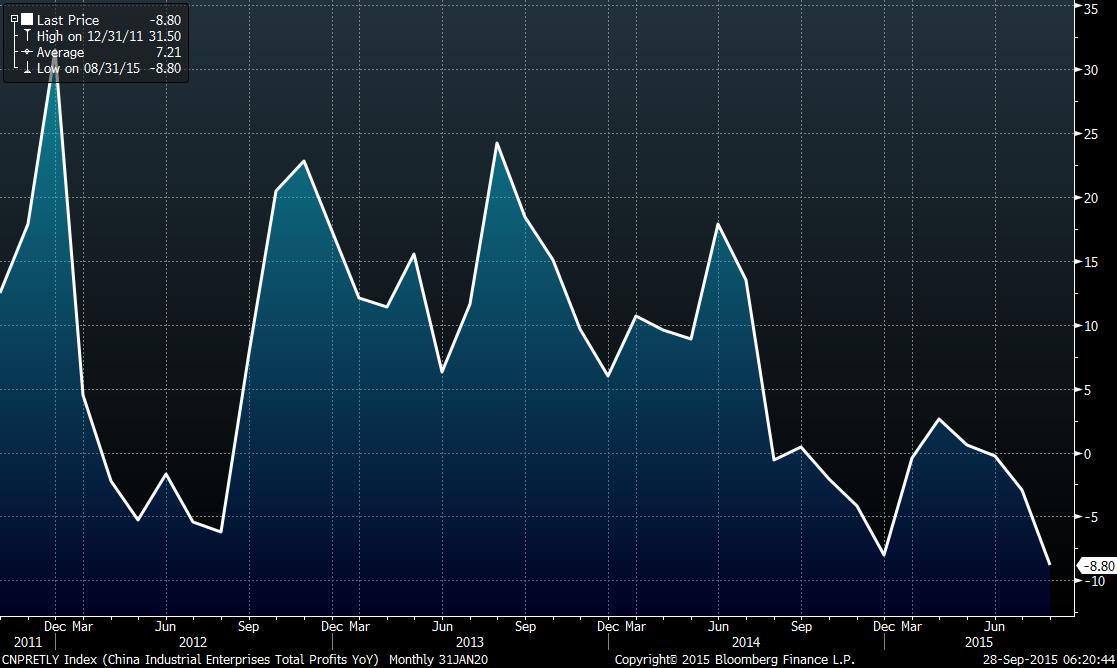

That’s the -10% line we’re testing on China’s Industrial Profits, which is the worst decline since the Government has been releasing the data (2011). “Companies are facing enormous operational pressures,” said Liu Xuezhi, a macroeconomic analyst at Bank of Communications Co. in Shanghai. “The momentum of growth is weak, and the downward pressure on the economy is relatively large.”

Click on picture to enlarge

I know the conventional wisdom is that, if we pretend China is not having a crisis for long enough, the crisis will go away but this is rapidly spilling over to other Asian economies and is now affecting Europe too. This is like when everyone in your family but you catches the flu and you just KNOW you’re going to get it – the only question is when. Coal mining profits in China, for example, are down 64.9% from last year so either they have converted 60% of their economy to renewables in 12 months or their economy is slowing considerably.

Keep in mind this is AFTER 5 interest rate cuts in the past year along with reduced reserve-requirements for the banks AND currency devaluations. As noted by Asia Analytics:

“The Chinese central bank can drop the price of money all it wants and shovel ever more cash into the banking system, but the problems facing the Chinese corporate world are more about the lack of customers than the lack of credit, more about insolvency than illiquidity.”

This is happening on our planet folks – not off in some distant galaxy! It amazes me how little concern people seem to have about what’s going on in China – as if we learned nothing at all 7 years ago – not even to be a little bit cautious. Well, I’m not going to try to convince you – I put up “Hedging for Disaster – NOW Are You Ready to Listen?” and the rest is up to you. I can only tell you what’s going to happen in the markets and how to profit from it – that’s the extent of my powers.

Leave A Comment