Last week in Monetary Paradigm Reset, we talked about the challenge of explaining a new paradigm. We said:

“The hard part of accepting this paradigm shift was that people had to rethink their entire view of cosmology, theology, and philosophy. In the best case, people take time to grapple with these challenges to their idea of man’s place in the universe. Some never accept the new idea”.

We were talking about the fact that money is the unit of account and the assertion that irredeemable paper currencies are money.

Monetary Relativity

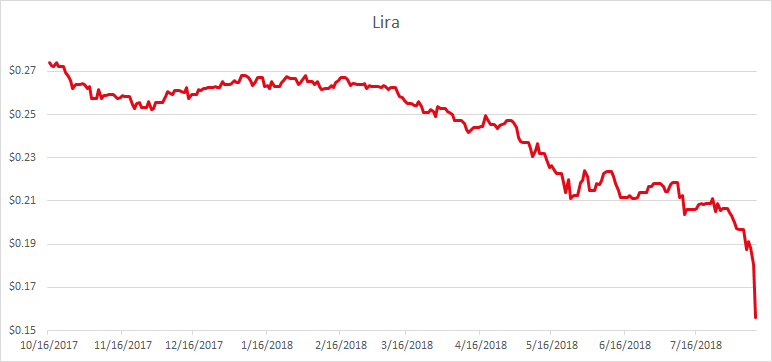

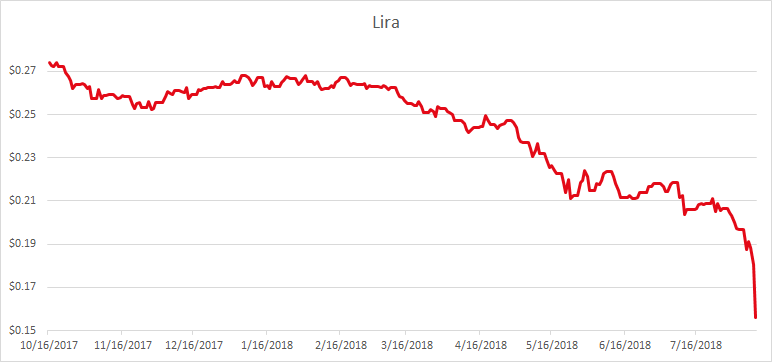

This week, Turkey provides an opportunity to discuss this in a way most people can relate to. Their currency, the lira, has been falling for years, but the rate of its plunge accelerated dramatically this week. It closed last week at 19.6 cents, but on Friday it was 15.5. This may not seem like a lot, but those 3.1 pennies are about 21 percent. In a week!

However, if the lira is money, then this is just our American bias speaking, isn’t it? To a Turk, the dollar closed last week at ?5.08 and this Friday at ?6.43 or a gain of 27%. Those who hold dollars in Turkey just got rich, right?

Which graph is objective?

Most people can see the principle clearly when it comes to the toilet-paper currency of a failing dictatorship. They wouldn’t say that the dollar is up 27%. The theory of currency relativity is not applied to this case.

It’s only with the dollar (and other major currencies) that things somehow become less clear. Did gold go down this week, or did the dollar go up? Everyone knows that the Federal Reserve strives to devalue the dollar at two percent per year. And they know that gold has been prized as money for thousands of years. Yet, when it comes to gold and the irredeemable dollar—they say that it’s gold which moves.

It’s obviously absurd to measure the dollar in terms of the Turkish lira. The lira is falling. Now, apply that same logic to the attempt to measure gold in terms of dollars. Take as long as you need.

The dollar went up from 25.61 milligrams of gold last week, to 25.7mg on Friday. Or, in silver terms, the dollar went up from 2.02 grams to 2.03g.

It’s more comfortable to say that gold went down $4. That doesn’t force one to confront any deeply-held beliefs about money. But back to a theme, we touched last week, the pre-Copernicus theory of the planets had to explain their apparent retrograde motion. What could make them seemingly stop in their orbits, move backward for a while, and then forward again?

The currently-prevailing view of the dollar as money has its own Medieval retrograde motion to explain.

Why Is Gold Going Down?

How the #$%&! could gold possibly be going down?!?

The Fed has long abused the dollar. Consumer prices, if not commodities prices, are rising. Shouldn’t gold go up to respond to Fed abuse, if not to keep up with inflation?

There is a popular theory to explain why gold is going down: a massive price-suppression scheme. Gold, in this view, is kept down by central banks who are surreptitious selling gold and keeping it on their books as swaps.

We must ask if this is so, then what of silver? The central banks haven’t got any silver. So if they are suppressing gold, but not silver, then silver would be much higher. How do you explain a gold-silver ratio of nearly 80 to 1?

So there is another explanation of suppression, that the banks sell paper futures. At least, it is true that such a scheme would equally apply to silver as to gold. However, Monetary Metals has proven in our Thoughtful Disagreement with Ted Butler that this is not occurring. In brief: if we look at how each futures contract behaves as it heads into expiration, we can determine if the banks are naked short. Monetary Metals has the data on every contract going back to 1996, and we share the data in that article.

Gold is money and the dollar is the much-abused irredeemable credit of the Federal Reserve, backed by the irredeemable credit of the US Treasury. Gold is not going anywhere, it’s the dollar which moves. At the moment, it is going up. Since April 19, the dollar has gone up about 2.58mg of gold.

Leave A Comment