Remember “good news is bad news”?

Of course you do. Because that’s the heart of the “Goldilocks” narrative that’s propping up risk assets.

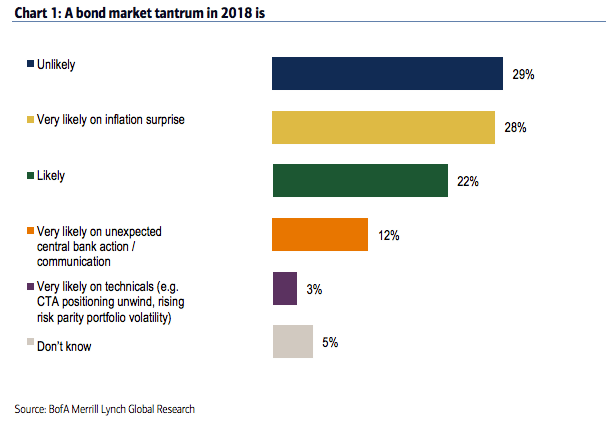

Bottom line: you do not want “too much” inflation pressure, because a sudden uptick in inflation could cause central banks to effectively revoke the market’s license to co-author the policy script by getting overly aggressive with the “hawkish” forward guidance. Recall this chart (note the yellow bar):

What does that mean? Well, it means that this morning’s CPI beat raises questions for stocks because again, “good” news (upbeat inflation print) is actually “bad” news (to the extent it argues for a removal of the punch bowl).

Sure enough, here’s the reaction in 10Y yields and futs:

“Paging Goldilocks” – you’re getting fucked out here.

Leave A Comment