This morning the National Association of Realtors released the July data for their Pending Home Sales Index. Here is an excerpt from the latest press release:

Lawrence Yun, NAR chief economist, says the staggering inventory woes throughout the country continue to stall contract activity. “With the exception of a minimal gain in the West, pending sales were weaker in most areas in July as house hunters saw limited options for sale and highly competitive market conditions,” he said. “The housing market remains stuck in a holding pattern with little signs of breaking through. The pace of new listings is not catching up with what’s being sold at an astonishingly fast pace.”

According to Yun, in the past five years, the national median sales price has risen 38 percent, while hourly earnings have increased less than a third of that (12 percent). This unsustainable trend is putting considerable pressure on affordability in some markets – especially for prospective first-time buyers – and is pricing out some households who would otherwise be looking to buy a home. Despite this growing obstacle, Yun says data and feedback from Realtors® continues to confirm that the slowdown in existing sales since spring is the result of a supply problem and not one of diminished demand. (more here).

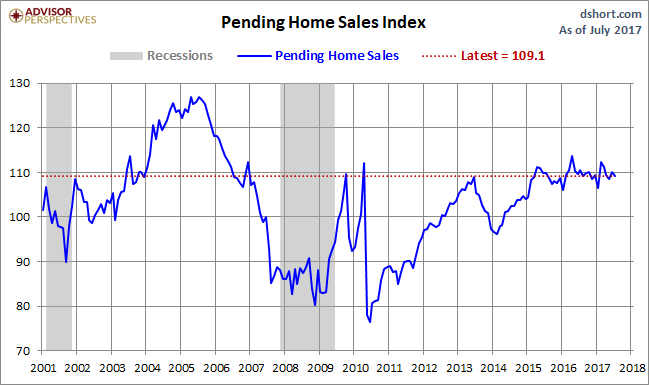

The chart below gives us a snapshot of the index since 2001. The MoM change came in at -0.8%. Investing.comhad a forecast of 0.5%.

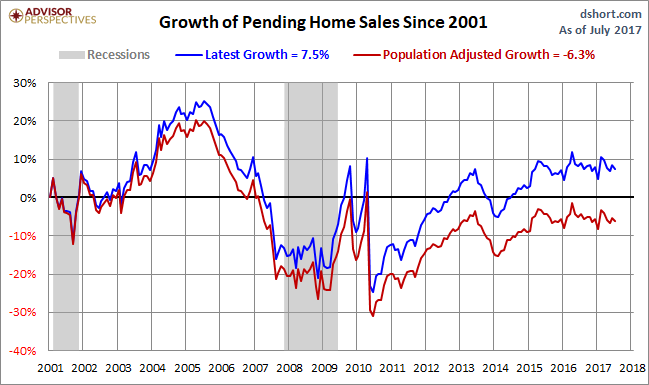

Over this time frame, the US population has grown by 14.7%. For a better look at the underlying trend, here is an overlay with the nominal index and the population-adjusted variant. The focus is pending home sales growth since 2001.

The index for the most recent month is 14% below its all-time high in 2005. The population-adjusted index is 22% off its 2005 high.

Pending versus Existing Home Sales

The NAR explains that “because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing Home Sales by a month or two.” Here is a growth overlay of the two series. The general correlation, as expected, is close. And a close look at the numbers supports the NAR’s assessment that their pending sales series is a leading index.

Leave A Comment