Silver prices saw a steep rise by the end of yesterday’s session. This came about as the US Dollar saw a broad-based pullback, which highlights that it’s not the demand of Silver which has increased, rather lower demand for the USD.

If silver prices break theNovember 16 high of $14.44 the price of silver may reach the November 9 high of $14.57 (and then $14.77 in case of an extension). However, unless we see a break of the November 16 high of $14.44 prices may easily slip and reach yesterday’s low.

We note that the FXCM SSI for the EURUSD turned net-short for short while in yesterday’s session. It’s a contrarian indicator and it suggests the EURUSD may trade higher, which is silver bullish.

See how retail traders are positioning in the majors in your charts using the FXCM SSI Snapshot.

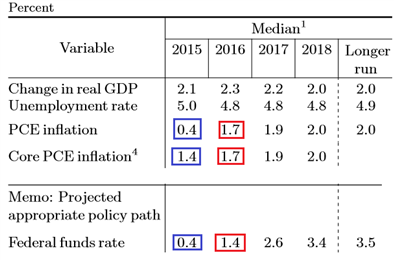

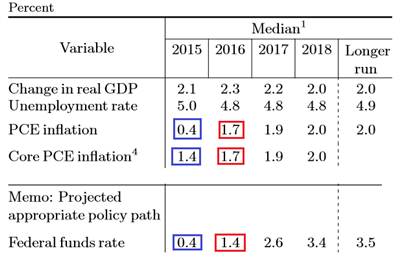

For now I am seeing the current pullback as a technical rebound as traders scale back the amount of rate hikes expected by the Fed over the next 12 months. A rate hike in December is still in play, but in their FOMC minutes published on Wednesday, the Fed highlighted that the path of rate increases will be data dependent. This suggests that if inflation does not pickup as the Fed projected in September, the amount of rate hikes will be small.

FED Projections September, 2015

Source: www.federalreserve.gov

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Leave A Comment