It’s no secret that non-GAAP earnings allow management to directly manipulate their performance metrics. Investors must look past non-GAAP metrics to protect their portfolios. While non-GAAP tricks may provide some short-term boosts to stock prices, eventually reality sets in and the true economics of the business rule the day.

Photo Credit: Al_HikesAZ (Flickr)

Why Non-GAAP Can’t Be Trusted

We spend lots of time explaining how GAAP earnings are not reliable measures of corporate profits, and non-GAAP earnings are worse. Most of the time non-GAAP earnings are blatant misrepresentations of profits for the benefit of corporate insiders at the expense of regular shareholders. Case in point is one of Bill Ackman’s favorites: Valeant Pharmaceuticals (VRX). That stock has cratered recently on the heels of long overdue coverage of its questionable accounting practices, about which we warned investors back in June 2014.

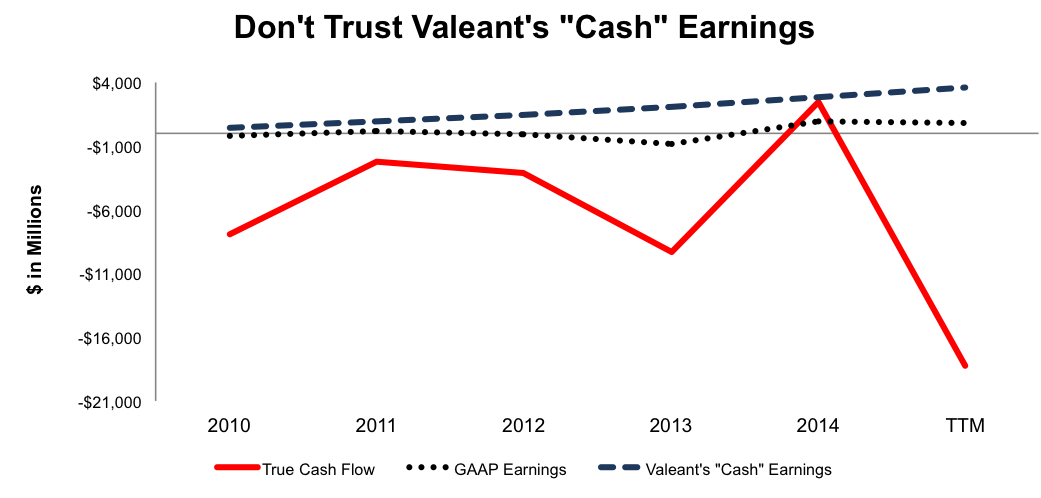

While arguments may persist over the future of Valeant, one thing is clear: the company’s use of non-GAAP earnings, or as they call it, “cash earnings”, has only misled investors while serving executives in four distinct ways. Since management wants investors to focus on cash, not earnings, we find the discrepancy between Valeant’s “cash earnings” and the company’s true cash flows alarming. Figure 1 shows: while the company’s “cash earnings” have been highly positive and grown from $421 million to $3.55 billion from 2010 thru the latest trailing-twelve-months (TTM), free cash flow has been highly negative with a cumulative -$38.4 billion in losses over the same time frame. Cumulate non-GAAP earnings, during the same time, are $11.2 billion.

Figure 1: Valeant’s Non-GAAP Tricks Have Tells For Those Who Look Closely

Sources: New Constructs, LLC and company filings

Non-GAAP Leads Investors Farther Away From The Truth About Profits

The key point for investors to remember about non-GAAP earnings is they are like lipstick on a pig. They only cover up the ugly, and they cannot change it. The more managers have to adjust GAAP, the worse the situation is likely to end for investors. Non-GAAP tricks may work for a while, but they cannot disguise a bad business forever. Another example is Demandware (DWRE). After rising 160% from January 2013 to June 2015, DWRE is down 36% since we placed it in the Danger Zone on June 23, 2015.

Leave A Comment