As the Federal Reserve reported most recently two weeks ago, US consumer non-mortgage debt has never been higher: as of December 31, 2017, US households had a record $1.0 trillion of credit card/revolving loans, a record $1.3 trillion of auto loans, and a record $1.5 trillion of student loans.

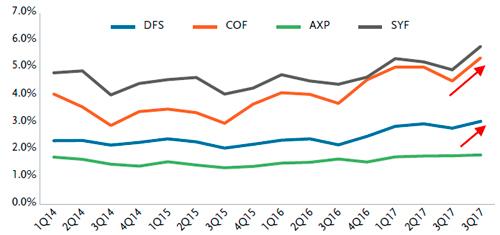

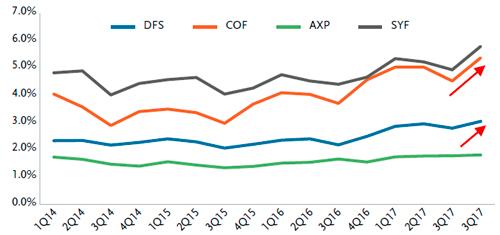

Among these, credit card and auto loans, in particular, have been experiencing accelerating delinquencies. As a result, finance companies/banks have been increasing bad debt provisioning to build balance sheet reserves due to expectations of rising defaults. The chart below illustrates the highest reported net charge-off rates (NCOs) in years.

Net Charge-Off Rate for Credit Card Companies

And while all major credit card companies and banks are experiencing increasing credit costs from the trough of late 2015, one would be remiss to spot this at the aggregate level.

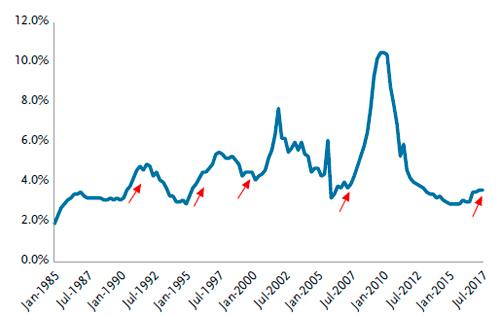

As the chart below courtesy of TCW, which illustrates modestly rising net charge-offs (i.e. defaults) for the entire U.S. banking universe, NCOs increased from a trough in 4Q15 at 2.9%, which coincidentally was the same quarter the Fed executed its maiden interest rate hike of this cycle, albeit very modestly.

Net Charge-Off Rate on Credit Card Loans, All Commercial Banks

Why the very gradual increase in aggregated NCO, and thus why the lack of economist concerns about the state of the US consumer? Simple: the larger U.S. banks that dominate credit card issuance have focused on prime and super-prime consumers post the Great Financial Crisis (GFC), and have enjoyed a prolonged period of low charge off rates concurrent with the Fed’s almost decade-long ZIRP.

However, since 2015 the Fed has progressively raised interest rates from ZIRP while NCOs at the larger banks have started to rise, albeit off a low base. NCOs were 3.6% at 3Q17, closing in on a 4% rate, a level that matched the end of previous business expansions in 2000 and 2008.

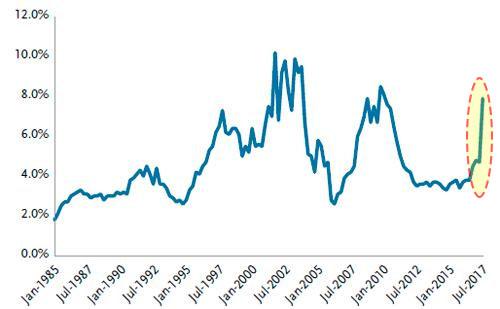

And here a startling discovery emerges.

As TCW’s Chet Malhotra notes, it is America’s smaller banks – those not in the Top 100 by asset size – that have experienced in just the recent months a surge in charge off deterioration, which at 7.9% is on par with the last financial crisis! In other words, to find where the next consumer credit crisis hides – and will erupt next – ignore the big banks and focus on the smaller ones.

Net Charge Off Rate on Credit Card Loans, (Banks Not in Top 100 by Assets)

Oddly, this spike in net charge offs among smaller banks has gone largely unnoticed by the general media which has traditionally focused on aggregate numbers and also the largest banks. So, as TCW asks, “is this a precursor to larger banks experiencing much higher loss trends as well or just anomalous?”

Time will tell: there is a possibility that the larger bank NCO rise be just another midcycle phenomenon pulled forward by Fed hikes such as in the mid-‘90s, while the small bank NCOs will stabilize and even revert.

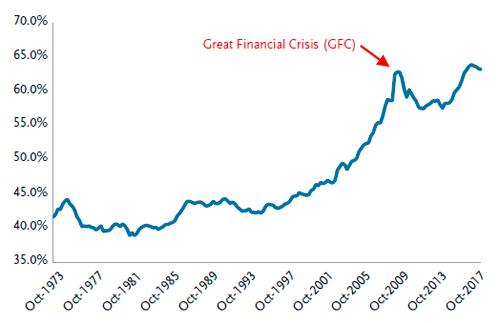

Yet, as TCW further notes, while it is possible that the current NCO increase is benign it is “far from certain in our view, given the current accumulation of overall leverage in the financial system expressed by Bank Credit/GDP at 63%, levels last seen in 2008” as shown below:

U.S. Bank Credit (Loans + Securities)/GDP

The problem is that while the above observation would be easy to dismiss in world of declining, or flat, interest rates, the Fed’s current tightening posture leads to substantial risks of even greater NCOs and defaults as a result of ever higher debt servicing costs, especially if Jay Powell hikes rates 4 more times in 2018 and more in future years.

Leave A Comment