A patient mind is the best remedy for trouble. – Plaut

2015 was not a good year for speculators trying to time the oil markets. Oil kept cutting through each support level like a hot knife cutting through butter. It would give the appearance that it was ready to mount a rally, but that rally would fade, and oil prices would drift lower. We penned an article in Nov of last year, where we stated that oil would have to close above $50 on a weekly basis for it to see higher prices. However, it failed to do that and drifted lower. When it closed below $32 on a weekly basis, it neutralized any tiny bullish signals it was issuing in 2015. Is oil close to putting in a bottom or will it once again let everyone down and plunge into a series of new lows. There is a saying that the cure for low prices is lower prices and vice versa; having said, that we expect one final wave of selling before oil bottoms out and starts to trend slowly upwards. We do not expect any violent upward reversals unless the situation between Iran and Saudi heats up to the point that a new war breaks out.

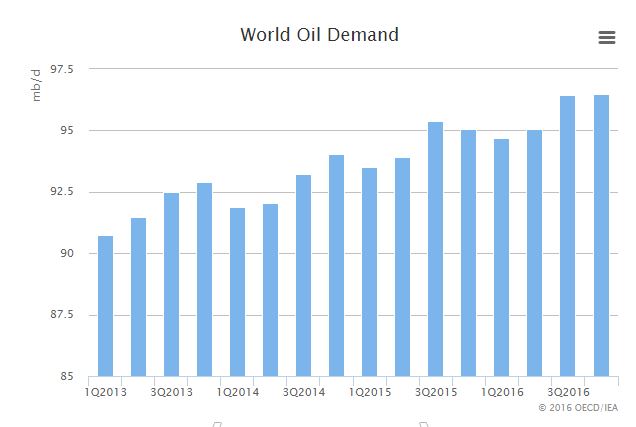

According to the IEA, oil demand for 2016 is expected to remain almost unchanged from 2015. In 2015, it stood at 96.43 million barrels per day (Mb/d) and in 2016, it is expected to be 96.49 Mb/d.

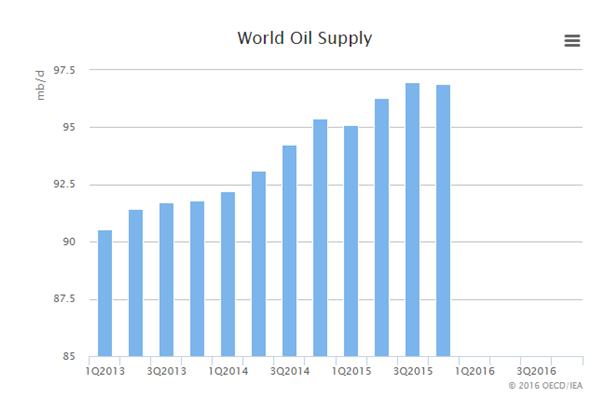

The interesting part is that the IEA expects supplies to drop from 96.97 Mb/d to 96.88 Mb/d; the IEA is generally notorious for missing its projections. We are not sure that the current projections fully factor in the new supply of Iranian oil set to hit the markets. Additionally, Russia has stated that they have no intention of cutting down oil supplies and the same holds true for Saudi.

Russia pumped a record 534 million tons of crude oil in 2016, and the country’s oil and gas condensate production increased by 1.4% year-on-year. Russia pumped that Russia’s oil production was poised to challenge its post-soviet record in the last of week of 2015 and surge to 10.86 million barrels per day. On the same token, Saudi Arabia instead of cutting production has been pumping oil close to its maximum capacity. From the supply side, there are no positive factors that would contribute to a sustainable upward trend for oil.

Leave A Comment