“Liquidity crunch” is the watchword in the bond trading market that threatens to cause deep rifts in the financial market. The fixed income market in the U.S. finds itself suffering from the unintended consequence of injecting half a trillion dollars in the market in the forms of corporate and sovereign bonds.

Companies in the US have offered record number of bonds this year with the assumption that the fed rates will remain low and investors will still have an increased appetite for fixed income financial instruments.

And up until now they have been spot on in their predictions about the federal rates. On September 17, 2015, the Federal Reserve members had unanimously decided to keep the rates low at 0% to 0.25%. But with the U.S. corporate bond ballooning by an astounding 47% from $5.4 trillion at the end of 2008 to $8 trillion currently, the stage looks set for the bursting of the bond market bubble.

Liquidity Crisis: A Fling or the Real Thing

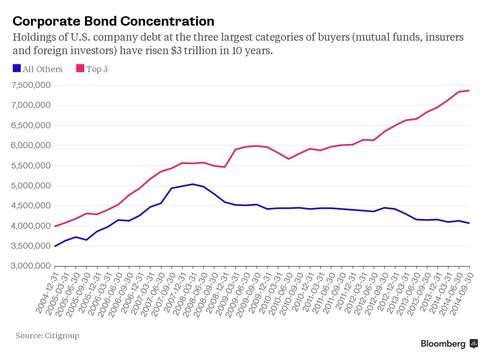

The size of the corporate bond market in the U.S. has increased by $2.6 trillion in the past seven years. However, most of the growth in the market has been concentrated in three types of buyers: i) Foreign Investors, ii) Mutual Funds, and iii) Insurance Companies, according to a report by Citigroup.

This represents a serious concern that can have a significant knock-out impact on the entire US economy. If the Fed pulls the trigger and increases the rates for the first time in nearly a decade, it could result in increased selling – much more than the market could absorb – leading to what experts are calling a severe liquidity crunch in the U.S.

The current situation in the bond market has the potential to bring the next financial crises that could have a ripple effect in every major industry in the U.S.

The lack of liquidity that currently exist in the fixed income market is something that the bond buyers, sellers, and regulatory authority need to be concerned about. In the past there were more than 23 different type of investors but now we have only three. And that according to analysts is the main reason that the bond market could pop.

All that is needed is a spark in the form of a fed rate hike that would fuel liquidity crises when the investors flee bonds. This shortage of liquidity could result in a fall in asset prices below their long run fundamental price, thereby deteriorating external financing conditions, a reduction in the number of market participants, or simply difficulty in trading assets.

Leave A Comment