Photo Credit: JD Lasica

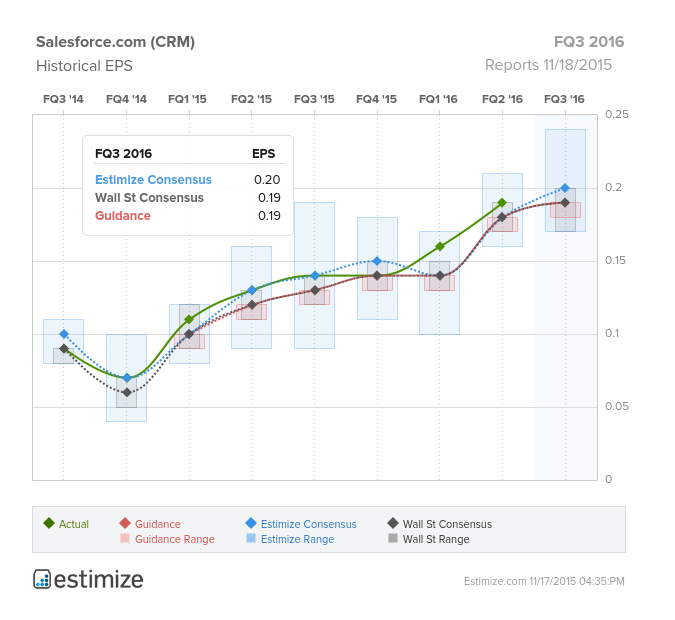

Salesforce.com, the leader in customer relationship management (CRM) and imminent player in cloud computing solutions, is set to report 3Q2016 earnings tomorrow after the closing bell. In the previous two quarters, the company has been backed by positive EPS and revenue surprises and looks to continue the trend this quarter. The Estimize consensus is predicting EPS of $0.20 and revenue of $1.71 billion as Wall Street is not quite as confident, estimating EPS of $0.19 and revenue of $1.70 billion.

European Investments

Salesforce Ventures, the firm’s global investment group, decided to utilize $100 million to invest in European startup companies to find the next stars in cloud computing innovation in mid October. According to a study conducted by the International Data Corporation, the European cloud software industry is expected to grow over 12 times quicker than other technology specific sectors to reach roughly 35 billion USD (33 billion euros) by 2019. Salesforce.com has been in the European space since 2009, but is planning a far more substantial involvement as only 17 of the 150 companies invested in are based in Europe. The Salesforce Ventures portfolio currently consists of European cloud companies like CloudSense, Qubit, Universal Avenue, and CartoDB.

A Focus on Growth

Salesforce.com has dominated the customer relationship market (CRM) and has made some heavy plays within the cloud computing services industry as well. The cloud sector is becoming a tech hotspot and despite the everyday increases in competition from IBM and Oracle, Salesforce has been able to strategically acquire hot startups to broaden its range of services provided and enhance its capabilities. Last quarter, the company put up some very strong numbers and is expected to continue to grow. Revenue figures improved by 24% on the year to $1.63 billion and EPS jumped to $0.19 from $0.13 the year before. In fact, Salesforce has not missed analyst expectations in the last 14 quarters.

Leave A Comment