Certain commodities tend to fly under the radar for periods of time.

For example, it was only in the last couple of years that markets have been able to digest the potential impact of the electric vehicle boom, and what it may mean for raw materials. The lithium, graphite, and cobalt prices reacted accordingly, and suddenly these essential ingredients for lithium-ion batteries were hot commodities.

Another one of those metals that comes and goes is zinc – and after shooting up in price over 35% this year, it definitely has the attention of many investors and speculators again.

RE-THINKING ZINC

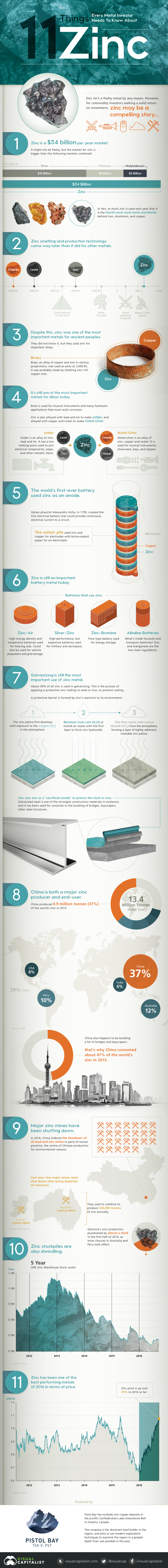

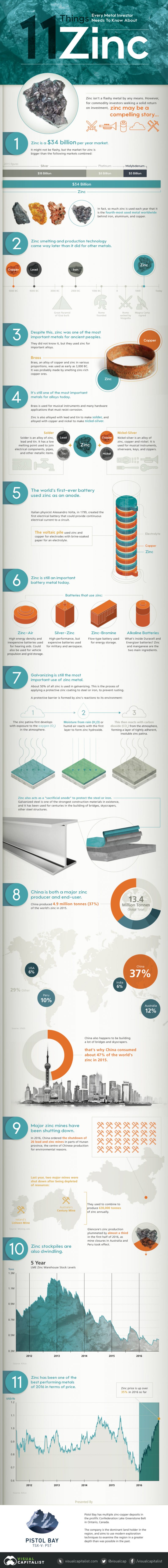

Today’s infographic comes to us from Pistol Bay Mining, a company that is too focusing on zinc, and it highlights 11 things that investors need to know about a metal that is gaining substantial momentum.

Here’s why the metal is back in fashion:

1. Zinc is a $34 billion per year market.

It’s bigger than the silver ($18 billion), platinum ($8 billion), and molybdenum ($5 billion) markets combined. In fact, it is the fourth-most used metal worldwide.

2. Zinc smelting and production technology came way later than it did for other metals.

The ancients were able to smelt copper, lead, and iron, but it wasn’t until much later that people were able to work with zinc in any isolated state.

3. Even despite this, it was a crucial metal for ancient peoples.

They would smelt zinc-rich copper ores to make brass, which was used for many different purposes including weaponry, ornaments, coins, and armor.

4. Zinc is also crucial to produce many alloys today.

For example, brass is used for musical instruments and hardware applications that must resist corrosion. Solder and nickel-silver are other important alloys.

5. The world’s first-ever battery used zinc as an anode.

The voltaic pile, made in 1799 by Alessandro Volta, used zinc and copper for electrodes with brine-soaked paper as an electrolyte.

Leave A Comment