The Canadian dollar is at an interesting juncture. Strong economic data has strengthened the currency but the Bank of Canada (BoC) has applied brakes on the currency’s rally. The Canadian dollar weakened in the wake of policy statements in October and December. The last word of 2017 went to the economic data as hot inflation numbers confirmed overhead resistance for USD/CAD at its 50 and 200-day moving averages (DMAs). USD/CAD closed out the year at a two month low and a lot of downward momentum.

During a brief period of consolidation against the U.S. dollar, the Canadian dollar bounced between economic data and the Bank of Canada. USD/CAD finally broke down in the last 10 days of the year in the wake of strong CPI numbers. Source: FreeStockCharts.com

From a technical perspective, note that USD/CAD rallied from its intraday low on Friday and formed a hammer pattern. A continued push higher from here would likely take the pair at least back to the upper boundary of the lower Bollinger Band (BB) channel.

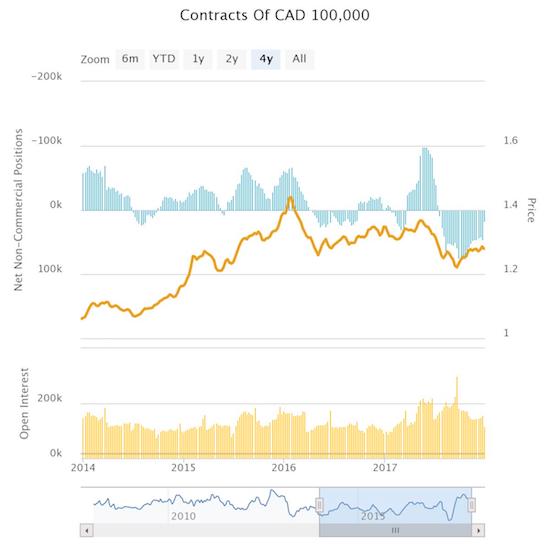

Interestingly, speculators backed off their bullishness going into year-end despite the strong economic data and rising oil prices. The declining trend in bullishness is important given the current cycle of net long contracts has been very prominent relative to the last four years dominated by bearishness.

Speculators are less bullish on the Canadian dollar (FXC). Net long contracts have not been this low since the latest cycle began in July, 2017. Source: Oanda’s CFTC’s Commitments of Traders

Here is a quick review of some of Canada’s key fundamental data and events for December.

December 1: Employment Report

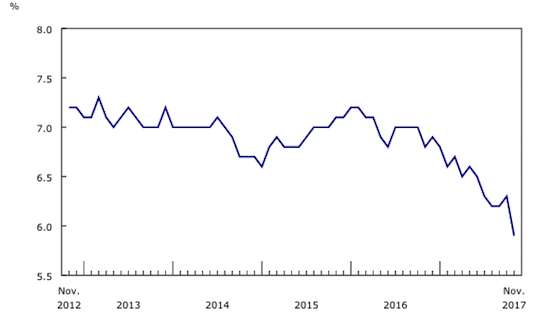

At 5.9%, the unemployment rate dropped to its lowest level since February 2008. The bulk of the employment gains came in Ontario where the unemployment rate dropped to its lowest level since July, 2000.

Canada has enjoyed a near 2-year decline in its unemployment rate. Source: Statistics Canada

December 1: GDP report

Third quarter real GDP rose 0.4% from the second quarter and 1.7% on an annualized basis. This was the lowest quarterly gain since GDP growth went negative in the second quarter of last year. The jobs data likely overshadowed the GDP data.

Leave A Comment