It’s Friday in the Wall Street Daily Nation!

That means the long-winded analysis is out. (Hallelujah!) And some carefully selected charts are in. (Amen!)

So without further ado, check out these snapshots showing the biggest potential beneficiaries of President Trump’s new tax plan, the single data point behind my continued bearishness on Twitter and why too much of a good thing can be a curse.

Show Me the (Tax) Money

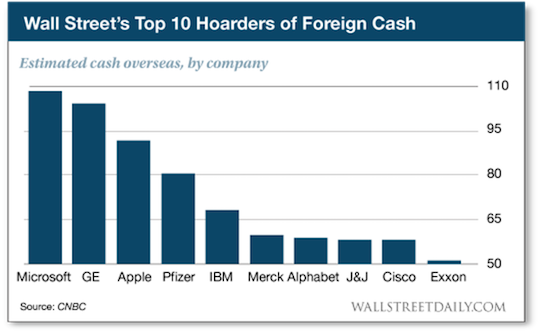

After much anticipation, President Trump revealed his tax plan this week. Or at least the framework of one. One of the biggest components is a tax holiday for U.S. firms that have been hoarding profits overseas.

We highlighted this cash pile earlier in the month. But it’s worth sharing again.

Why? Because once the tax plan becomes official, this cash is guaranteed to make its way from company coffers to shareholders in the form of increased dividends, share buybacks and acquisitions.

It’s the last use of cash — acquisitions — that interests us most here.

If we can identify the small-cap firms in the takeover cross hairs beforehand, we stand to make overnight gains of 50% or more.

Buyout premiums are already on the rise, recently reaching levels not seen in almost a decade. If the market is suddenly flooded with excess cash from tax repatriation, watch out! Bidding wars are bound to erupt.

If you want to make sure you benefit from the action, test-drive our premium advisory True Alpha. Our current portfolio of 21 companies are almost all tempting takeover targets.

The other important observation here is this: With the Nasdaq eclipsing the 6,000 mark this week, everyone is panicking and screaming, “Overvalued, overvalued!”

But when we take these high cash balances into consideration, many tech giants aren’t that expensive after all.

Microsoft, Oracle, Cisco, Apple and Google are all trading between 14 and 20 times forward earnings. That’s a far cry from the nosebleed valuations witnessed during the dot-com days. And if we back out the mountains of cash on hand, the valuations get even cheaper.

Leave A Comment