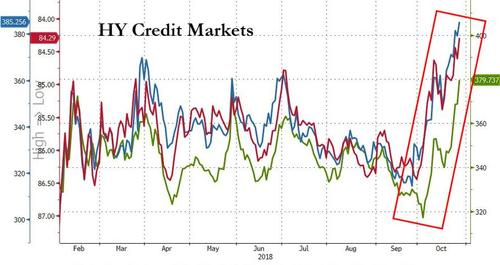

This month’s violent market rout, which sent both the S&P 500 and Dow to unchanged for the year and pushed most global markets into a bear market, has delivered several other dubious distinctions across asset classes. After seemingly untouchable, many credit spreads (US HY, Euro HG and HY) have widened to their highest levels this year.

While EM Equities and EM Asian currencies have made new 18-month lows, and every market – including the Nasdaq, commodities and US Leveraged Loans – has underperformed the trade weighted USD in 2018.

However, as JPMorgan’s John Normand observes in his latest weekly note, there is another more “jarring” perspective on this year’s cross asset (under)performance:only on two prior occasions – the 1970’s stagflation and the global financial crisis – have so many asset classes had negative returns in one year.

“the percentage of asset classes that has generated positive returns this year is only 20%, a share that has never been so low outside of 1970s stagflation episodes and the Global Financial Crisis.”

According to JPMorgan there are three likely explanations for this “misery”:

Whatever the reason behind the drop, the violence of the market reaction surprised Normand and his team.

The JPMorgan strategists note that they have “no argument with the obvious statement” that the most obvious explanation for such steep declines in risky markets this month is that global growth and US earnings are peaking. In fact, as validation they note that global growth, proxied by JPM’s global composite PMI reached its zenith around February 2018 and has been decelerating steadily since; EM has slowed on the trade war, and the financial stress triggered by the interaction of Fed tightening, domestic imbalances and some bad policy choices. Europe has also slowed on trade, German-specific production issues and Italian politics; Japan has stumbled temporarily on a series of natural disasters. Meanwhile, the US peaked at 4.1% in Q2 and has slowed to 3.5% in Q3 as the fiscal impulse normalizes and interest-sensitive sectors like housing respond to higher rates. On a related note, US corporate profits growth was always expected to start slowing in Q3 as the tax boost fades, and they are doing that on cue.

Leave A Comment